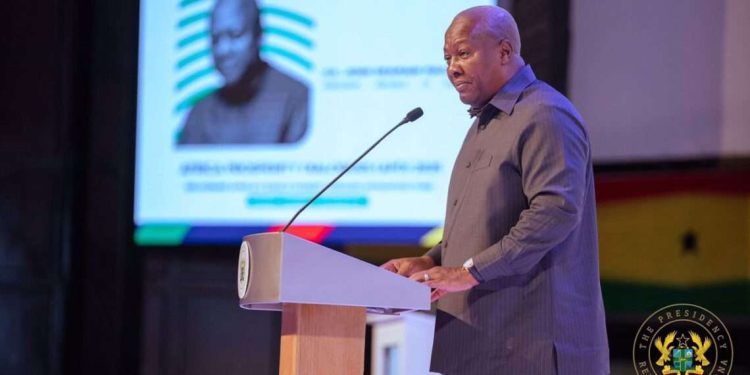

President Mahama Urges Bold Economic Reforms for Africa’s Future

President John Dramani Mahama delivered a stirring appeal to African leaders: move swiftly beyond political independence and rhetoric to real, practical economic reforms that will transform lives across the continent. The summit, which also welcomed São Tomé and Príncipe’s President Carlos Manuel Vila Nova, became a stage for President Mahama’s vision of an Africa where governments prioritize the well-being and safety of their people through deliberate development strategies. In a Facebook post reflecting on the summit, President Mahama underscored that democracy and political freedom mean little without concrete efforts to build sustainable livelihoods. “Political freedom without economic transformation remains incomplete,” he reminded his audience, urging governments to embrace reforms that bring tangible benefits to their citizens. Central to his message was the need for industrial growth and job creation—goals that, he acknowledged, require significant capital. President Mahama pointed out that small and medium-sized enterprises (SMEs), the backbone of Africa’s industrial workforce, still face significant barriers due to limited access to long-term, affordable financing. He proposed a solution: African nations should rethink how they mobilize and direct domestic resources. Instead of allowing pension funds, insurance companies, and sovereign wealth funds to sit idle or be invested abroad, President Mahama urged that these vast resources be channeled into productive ventures through mechanisms like industrial bonds, infrastructure funds, and diaspora financing. Such investments, he argued, could unlock the capital needed to fuel industrial expansion, boost intra-African trade, and accelerate economic transformation. With strengthened regional cooperation and innovative financing, President Mahama expressed confidence that Africa could secure inclusive growth and long-term prosperity for all its people. Source: Apexnewsgh.com

CSA Issues Alert Over Sophisticated Banking Malware Spreading via WhatsApp Web

In a recent wake-up call to the public, the Cyber Security Authority (CSA) of Ghana has sounded the alarm for Windows users, warning of a dangerous new threat lurking in the digital shadows. The culprit: a sophisticated banking malware campaign that is making its rounds through WhatsApp Web, putting both individuals and organisations at risk of devastating financial loss. Known as Astaroth, the malware has been identified as a major concern by the CSA. The attackers’ method is deceptively simple yet highly effective—they begin by sending malicious ZIP files to potential victims through WhatsApp messages. Disguised as legitimate documents or shared under seemingly innocent pretexts, these files are designed to lure unsuspecting users into downloading and opening them. The real danger begins after the ZIP file is extracted and executed on a Windows computer. Once inside, Astaroth quietly installs itself, immediately connecting to WhatsApp Web to harvest the victim’s contact list. In a matter of moments, the malware sends similar malicious messages to everyone in the contact list, spreading itself further, all without the user’s knowledge. While the malware operates in the background, it conducts extensive data harvesting, stealing sensitive information such as banking login credentials, one-time passwords (OTPs), browser cookies, and even keystrokes. With this trove of stolen data, cybercriminals can gain unauthorized access to financial accounts, commit fraud, and orchestrate further crimes. The CSA urges anyone who suspects they have been targeted or affected by such attacks to reach out for help. Victims and concerned individuals can report incidents and seek guidance by calling or texting 292, using WhatsApp at 0501603111, or emailing report@csa.gov.ghOpens a new window. The message from the CSA is clear: stay vigilant, be wary of unexpected files received via WhatsApp, and report suspicious activity promptly to help combat this growing cyber threat. Source: Apexnewsgh.com

President Mahama Champions AfCFTA as Catalyst for Africa’s Industrial Transformation

It was a momentous occasion at the 2026 Africa Trade Summit, where President John Dramani Mahama stood before a distinguished audience and painted a bold vision for Africa’s industrial future. At the heart of his address was the African Continental Free Trade Area (AfCFTA), which he hailed as the most ambitious integration project ever undertaken on the continent. With passion, President Mahama described the AfCFTA as a game-changer, uniting over 1.3 billion people into a single market and positioning Africa as a serious player in global manufacturing and investment. He emphasized that, for decades, African economies had remained fragmented, limiting their ability to compete on the world stage. But with the AfCFTA, he explained, countries now had a unique opportunity to build industries capable of serving both regional and international markets. Ghana, he proudly noted, had the honour of hosting the AfCFTA Secretariat and was among the first countries to trade under the agreement’s new preferences. Yet, President Mahama cautioned, the benefits of a continental free trade area would not materialize automatically. He urged African leaders to anchor the AfCFTA within robust development strategies, linking it to industrial policies, infrastructure investment, support for enterprise growth, and trade facilitation reforms. “Without these complementary measures,” he warned, “market integration will remain a theory rather than a driver of prosperity.” He went on to stress that true industrialisation could not thrive within the confines of isolated national markets. Instead, Africa’s future, he argued, depended on building regional value chains—integrating production processes across borders so that, together, African countries could develop strong and competitive industries. President Mahama outlined the vital enablers needed for this transformation: investment in transport corridors, energy and digital infrastructure, and harmonised regulations. These, he said, would lower business costs, boost connectivity, and make seamless intra-African trade a reality. As his speech drew to a close, President Mahama left his audience with a challenge: to move beyond signing agreements and to focus on implementation that would drive industrial growth and shared prosperity. The AfCFTA, he said, was more than a vision—it was Africa’s historic opportunity to reshape its economic destiny. Source: Apexnewsgh.com

GHC 300 Debt Turns Deadly: Man Killed in Fatal Fight in New Nkusukum

A seemingly trivial debt of 300 Ghana cedis (GHC 300) has ended in tragedy, claiming the life of a man in the New Nkusukum area of the Mfantseman Municipality in the Central Region. The victim, identified as Agyeiku, reportedly died following a violent altercation with his friend and fellow labourer, Kwame Pluto. According to eyewitnesses and local accounts, the incident unfolded after the two men, who worked together as informal “hustlers,” returned home from a day’s work. As they prepared to share their earnings, Agyeiku asked Kwame Pluto for his portion. An argument broke out when Kwame Pluto allegedly refused to hand over the money. The disagreement quickly escalated: Agyeiku tried to restrain Kwame Pluto to secure his payment, prompting Kwame Pluto to allegedly draw a sharp object, described as a “size,” and stab Agyeiku multiple times. The brutal attack left Agyeiku severely wounded. He later fainted and was rushed to the Roman Catholic Hospital in Mankessim around 8 PM. Despite efforts by medical personnel, Agyeiku succumbed to his injuries. Alhaji Ali Abubakar Soring, Assembly Member for New Nkusukum, confirmed the incident and expressed profound sorrow over the needless loss of life. He revealed that the suspect, Kwame Pluto, has been remanded in police custody at Cape Coast Ankafu for two weeks pending further investigation. Family members and eyewitnesses recounted that the confrontation began after the pair returned from a funeral in Kumasi, a disagreement that tragically spiraled out of control. The local community has been left shocked by the deadly violence over such a minor debt, with many stressing the urgent need for peaceful conflict resolution in such matters. Police investigations are ongoing to determine the full circumstances and ensure justice is served for Agyeiku. Source: Apexnewsgh.com

Fire Strikes Kumasi Again: Anwona Market Blaze Raises Alarm

Barely a day after the Sofoline Magazine fire disaster, the Kumasi Metropolis was shaken by another major blaze, igniting fresh concerns about fire safety in the city’s bustling commercial centers. On Monday night, around 10:00 pm, flames erupted at Anwona Market near Afful Nkwanta. The fire swept rapidly through the market, destroying several shops and all their contents. The scene was chaotic, with traders and residents looking on in despair as their livelihoods vanished before their eyes. Personnel from the Ghana National Fire Service responded swiftly. Their determined efforts managed to contain the inferno, preventing it from spreading to adjoining structures and nearby properties, a move that likely spared the community from even greater devastation. While the cause of the fire is yet to be officially confirmed, eyewitnesses suggest it may have begun in a section of the market that housed a footwear factory. Thankfully, no casualties have been reported. However, the economic toll is heavy, as traders have suffered significant losses, with valuable goods and equipment reduced to ashes. In the aftermath, investigators from the Fire Service have launched a probe to determine the exact cause of the incident. Meanwhile, city authorities are renewing urgent calls for improved fire safety measures in Kumasi’s markets and commercial hubs, hoping to prevent similar tragedies in the future. Source: Apexnewsgh.com

Registrar of Companies Announces Nationwide Increase in Service Fees Starting February

A new wave of changes is set to sweep through Ghana’s corporate sector as the Office of the Registrar of Companies (ORC) prepares to implement higher service charges nationwide beginning Monday, February 2, 2026. The ORC’s decision to revise its fee structure comes in response to the fees (Miscellaneous Provisions) Regulations, 2025 (L.I. 2512), which mandate all public sector institutions to periodically review and adjust their service costs. The move is designed to ensure that fees remain in line with operational realities and the rising costs associated with delivering public services. According to a statement obtained by Joy Business, the fee adjustment will affect the entire menu of services provided by the Registrar of Companies. From company registrations and business name filings to a host of other corporate procedures, clients across the country will be subject to the new pricing. While the ORC has not yet released the specific figures for the updated charges, officials have assured the public that a comprehensive list will be displayed at all ORC offices and published on the official website well before the revised fees come into effect. Clients and stakeholders are being urged to acquaint themselves with the forthcoming changes and plan their business dealings accordingly to avoid surprises after the commencement date. The ORC’s revision is part of a broader government initiative to standardize and update charges across all public institutions, following the recent Parliamentary approval of the Fees Regulations, 2025. The National Identification Authority, for example, has already announced similar increases to its service fees, citing the need to sustain and improve service quality. With the deadline approaching, Ghana’s business community is bracing for the new fee regime, one that aims to support operational efficiency and enhance service delivery, but will also require careful planning and budgeting by entrepreneurs and corporate clients alike. Source: Apexnewsgh.com

Importers and Exporters Applaud Delay of Smart Port Note as Stakeholders Seek Broader Dialogue

A wave of relief swept through Ghana’s trade community this week as importers, exporters, and associated businesses welcomed the decision to postpone the much-anticipated Smart Port Note (SPN) initiative. The announcement, made by the Ghana Shippers Authority (GSA) in a widely circulated public notice, came after industry stakeholders raised concerns about the need for deeper consultation and clarification before the system’s rollout. The SPN, originally slated to take effect on February 1, 2026, was unveiled by the GSA on December 23, 2025, with the promise of modernising port operations and stamping out inefficiencies. However, as the implementation date approached, unresolved issues, particularly around operational logistics, regulatory compliance, and the introduction of new fees, prompted calls for a careful reassessment. According to the GSA, the postponement is intended to allow more time for meaningful dialogue with all affected parties. “This is a careful adjustment of one of our major port digitisation initiatives,” the Authority stated. “We want to ensure that operational, regulatory, and implementation concerns are fully addressed before the system goes live.” For industry leaders, the pause is not only welcome but necessary. Samson Asaki Awingobit, Executive Secretary of the Importers and Exporters Association of Ghana, explained to Citi Business News why the deferment was critical: “Messages have gone out globally to exporters and suppliers, alerting them to a potential new charge that would ultimately be passed on to local importers. When we examined the proposed figures, some of the values were quite high. It was clear we needed to defer the rollout, reconvene, and ensure all stakeholders, including those raising cost concerns, had a seat at the table.” Michael Obiri-Yeboah, Convenor of the Coalition of Concerned Exporters, Importers and Traders, echoed this sentiment, describing the delay as “a step in the right direction.” He stressed the importance of inclusive discussion: “We’ve seen prominent voices within the port community express reservations about the SPN. This postponement validates our concerns and opens the door to proper stakeholder engagement. Now, we can clearly articulate why the SPN may not be necessary in its current form, or work collaboratively to shape a more effective policy.” With the postponement in place, the mood among stakeholders is one of cautious optimism. Many believe that sustained engagement and open dialogue will ensure that any future digitisation of Ghana’s ports is both efficient and equitable, balancing the needs of government with the realities faced by those who keep the nation’s trade flowing. As the GSA prepares for renewed consultations, the business community is hopeful that the next version of the Smart Port Note will reflect a broader consensus, one that truly supports Ghana’s ambitions as a modern hub for international commerce. Source: Apexnewsgh.com

Trade Minister Announces Major Loan Recoveries and Probes at Ghana EXIM Bank

The atmosphere was one of transparency and resolve as Elizabeth Ofosu-Adjare, Ghana’s Minister of Trade, Agribusiness and Industry, addressed the nation during the Government Accountability Series on Wednesday, January 21. At the heart of her address was a significant development in the country’s efforts to tighten financial oversight and ensure the prudent use of state resources: the recovery of GH¢107 million in loan repayments and a fresh investigation into questionable loan disbursements by the Ghana EXIM Bank. Standing at the podium, Minister Ofosu-Adjare outlined the government’s multi-pronged approach to strengthening the credit system. She explained that, in 2025, Ghana EXIM Bank disbursed a total of GH¢304 million in loans under a stringent new policy. “This is not money for the boys or money for the girls,” she emphasized, underscoring the seriousness with which her ministry now approached credit creation. “You must satisfy requirements. You must show the credit you are taking will benefit the economy, and above all, you must demonstrate your ability to repay.” Her remarks reflected a shift toward greater accountability in public lending. The Bank’s stricter credit policy was already bearing fruit: GH¢107 million had been successfully recovered from loans that had long gone unpaid. “Recovery efforts on legacy loans are ongoing,” she continued. “We have initiated legal proceedings on several cases, and others have been referred to the appropriate security agencies for further action.” But even as the government celebrated these achievements, the Minister did not shy away from ongoing challenges. She revealed that some loan disbursements remained shrouded in mystery, with officials unable to account for how the funds had been issued or used. These cases, she said, had been swiftly referred to security agencies for thorough investigation. “There are loans that we do not know how they were disbursed,” Ofosu-Adjare admitted candidly. “We have referred them to the appropriate quarters to be dealt with expeditiously.” The Minister’s address was a clear signal that, under her watch, financial stewardship would not be taken lightly. With GH¢107 million recovered and further investigations underway, the government was not only reclaiming lost funds but also restoring public confidence in Ghana’s financial institutions. As the session concluded, observers noted a renewed sense of accountability—a promise that every cedi lent by the state must serve the nation’s interest, and that those who violate this trust will face the full scrutiny of the law. Source: Apexnewsgh.com

Eric Adjei’s Vision Transforms NEIP Into a Launchpad for Ghana’s Young Entrepreneurs

When Eric Adjei ESQ. stepped into the role of Chief Executive Officer of Ghana’s National Entrepreneurship and Innovation Programme (NEIP) in January 2025, he brought with him more than just a new title; he brought a wave of optimism and resolve that has reverberated across the country’s entrepreneurial landscape. From his first day, Mr. Adjei made it clear that entrepreneurship in Ghana would no longer be treated as a buzzword or a distant dream. “We must move beyond rhetoric,” he declared at his inaugural staff meeting. “Our young people deserve real opportunities, measurable, visible, and life-changing.” With these words, NEIP began a transformation from a policy-driven institution to a results-oriented engine of job creation and innovation. At the heart of Adjei’s approach lies a simple but powerful conviction: Ghana’s future depends on the ingenuity and energy of its young people. Under his stewardship, NEIP has redirected its focus toward small and medium-sized enterprises (SMEs), particularly those led by the youth. Practical support, accountability, and measurable outcomes have become the guiding principles. This renewed direction soon found its flagship in the Edwumawura Programme, a nationwide intervention that quickly became the talk of the entrepreneurial community. Edwumawura, meaning “Job Creator,” is more than just a catchphrase. It is a comprehensive initiative designed to empower aspiring entrepreneurs across the nation, regardless of where they live. From the busy streets of Accra to the most remote villages, the programme has reached Ghanaians who might otherwise have been left behind. The Edwumawura Programme was launched with fanfare but backed by substance. Its aim: to provide startup capital, business development services, and mentoring for individuals with promising ideas—especially at the grassroots. The process is inclusive and decentralized, ensuring that opportunity is not a privilege of the few, but a right for all with drive and determination. One young participant, Amina, from Tamale, recalls how the programme changed her life: “I always had ideas but no way to make them real. Edwumawura gave me training, a small grant, and the confidence to begin my poultry business. Now, I employ three people from my community.” Stories like Amina’s are becoming increasingly common. Across Ghana, young entrepreneurs are starting businesses, creating jobs, and building hope, thanks in large part to NEIP’s revitalized approach under Adjei’s guidance. But Adjei’s vision extends beyond traditional business models. Recognising the explosive growth of the digital economy, he championed a bold new initiative: NEIP would support content creators as legitimate entrepreneurs. In a country where millions of youth consume and create digital content daily, this was a game-changer. Workshops and mentorship sessions sprang up in cities and towns, focusing on skills from video editing to digital marketing. For the first time, Ghanaian content creators were given training, access to funding opportunities, and help in building digital brands with global reach. Kwame, a young YouTuber from Kumasi, shares his experience: “Before NEIP’s support, I struggled to monetise my channel. Now, I understand branding, and I’ve tripled my income. NEIP treated me like any other entrepreneur.” This push into the digital space reflects a broader understanding of modern entrepreneurship—one that values creativity, technological savvy, and the ability to adapt to a rapidly changing global economy. Observers note that Eric Adjei’s background as a lawyer blends seamlessly with his entrepreneurial drive. He insists on accountability and transparency, regularly engaging with stakeholders from both the public and private sectors. His collaborative style has fostered partnerships that multiply the impact of NEIP’s programmes, drawing in investment and expertise from across the spectrum. Through it all, Adjei has maintained a relentless focus on innovation-driven growth. He is often seen visiting project sites, speaking with beneficiaries, and seeking feedback on how programmes can be improved. “Real impact,” he often says, “comes from listening to those we serve.” As NEIP continues to roll out new initiatives, expectations are soaring. The Edwumawura Programme and the content creation support scheme stand out as two pillars of a new era, one in which entrepreneurship is accessible, rewarding, and central to Ghana’s economic development. For Ghana’s youth, Eric Adjei’s leadership marks a turning point. No longer is entrepreneurship reserved for the privileged or the well-connected. Today, ideas are nurtured, innovation is celebrated, and young people are empowered to become the job creators of tomorrow. In the words of one beneficiary, “With NEIP and Mr. Adjei, we know our dreams are possible. Source: Apexnewsgh.com

Ghana’s Economic Renewal: Vice President Engages IMF Leaders on Path to Sustainable Growth

Ghana’s Vice President, Prof. Naana Jane Opoku-Agyemang, has convened a high-level meeting with the heads of International Monetary Fund (IMF) country and regional offices across Africa. Against a backdrop of shifting economic tides and global uncertainty over debt and development financing, the gathering offered an opportunity to examine Ghana’s economic journey and its place within the continent’s broader narrative. Taking her seat at the table, Prof. Opoku-Agyemang was resolute. She began by acknowledging the daunting challenges that had recently confronted Ghana, the currency’s turbulence, inflationary spikes, and the strain of external shocks that had tested the nation’s resilience. But she was equally determined to spotlight the progress made since those turbulent times. “Our present situation is a testament to Ghana’s resolve,” she told the assembled IMF officials. “We have moved from the brink to a place of cautious optimism. Single-digit inflation is not just a statistic, but a sign of stability returning to everyday life. The Cedi has found firmer footing, and real GDP growth is no longer a distant hope, but a present reality.” The Vice President explained that these improvements were not confined to the realm of economic indicators, they were beginning to tangibly uplift businesses, households, and communities throughout Ghana. Farmers, traders, and entrepreneurs were regaining confidence. Investment was stirring anew. The sense of renewal, she stressed, was driven by reforms owned and designed by the Ghanaian people. “These are not prescriptions handed down from abroad,” Prof. Opoku-Agyemang asserted. “They are policies we have chosen, and sacrifices we are prepared to make, knowing that the path to recovery is neither quick nor easy.” She acknowledged, however, that the role of international financial institutions such as the IMF remained significant, especially as Africa faced not only its own structural challenges but also the ripple effects of global economic pressures. Yet, there was a new current running through the continent: an emerging self-assurance and a readiness to define Africa’s development priorities on its own terms. “We are not turning away from partnership,” the Vice President clarified. “Rather, we seek collaborations that are balanced, forward-looking, and tailored to our continent’s aspirations. Our relationship with the IMF, for example, must evolve beyond crisis-response programs to embrace true, development-oriented partnership.” Prof. Opoku-Agyemang echoed the vision of President John Dramani Mahama, emphasizing that Ghana’s future lay in self-reliance, but not isolation. She pointed to transformative opportunities on the horizon, notably the African Continental Free Trade Area (AfCFTA), which promises to unlock trade, investment, and innovation across borders. The conversation turned to the challenges that persisted, high borrowing costs, structural bottlenecks, and the need for coordinated action to ensure fair financing for Africa’s development. Yet, there was a palpable sense of hope: that with prudent reforms and supportive partnerships, Ghana and its neighbors could chart a course toward sustainable growth. As the meeting drew to a close, Prof. Opoku-Agyemang reaffirmed Ghana’s commitment to this new chapter. The country, she said, would continue to build on its hard-won gains, deepening reforms and strengthening the foundation for a more inclusive and prosperous future. And as Ghana advanced, it would do so with a clear-eyed vision, guided by national ownership, mutual respect, and a steadfast belief in the potential of its people and partnerships. In the heart of Accra, and in the corridors of global finance, the message was clear: Ghana’s economic story was entering a new phase, one defined not by crisis, but by confidence, cooperation, and the pursuit of lasting progress. Source: Apexnewsgh.com