Banks in Ghana are being urged to rethink their profit strategies as the country’s interest rate environment continues to normalize.

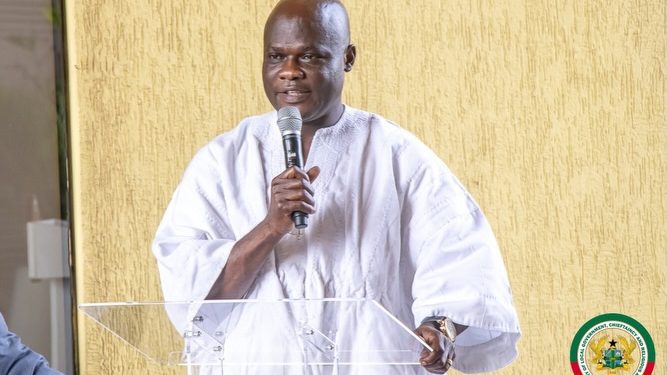

Governor of the Bank of Ghana, Dr. Johnson Asiama, delivered this cautionary message to banking executives at a recent Monetary Policy Committee (MPC) meeting, where he revealed that nearly 68 percent of industry profitability currently stems from net interest income, the spread earned on loans and government securities versus what is paid on deposits.

Dr. Asiama acknowledged that while interest income remains a core aspect of banking, excessive dependence on it exposes banks to the risks of fluctuating interest rates and sovereign market dynamics. “There is nothing inherently problematic about net interest income,” he noted, “however, a high dependence on it increases sensitivity to interest rate cycles and sovereign exposure dynamics.”

A recent review by the central bank highlighted limited financial intermediation, with loans comprising less than a fifth of total industry assets, while asset concentration in government and central bank securities remains high. This means banks’ profitability is closely tied to monetary policy decisions.

The warning comes as Ghana’s macroeconomic landscape shows signs of stability. The Bank of Ghana recently cut its benchmark policy rate by 250 basis points to 15.5 percent, citing rapid disinflation and anchored inflation expectations. Headline inflation dropped dramatically from 23.8 percent in December 2024 to just 3.8 percent in January 2026, the lowest since the adoption of inflation targeting. Real GDP expanded by 6.1 percent in the first three quarters of 2025, led mainly by growth in services and agriculture.

This easing cycle has already led to falling money market yields. Treasury bill rates have declined for three consecutive weeks, with the 91-day bill now at 8.61 percent, the 182-day at 10.68 percent, and the 364-day at 11.06 percent, well below the year’s start. While this spells relief for government borrowing, it also signals shrinking margins for banks that rely heavily on these investments.

Dr. Asiama urged banks to diversify their revenue streams beyond interest income, suggesting a stronger focus on transactional banking, trade finance, payments services, treasury operations, and other fee-based businesses that are less sensitive to changing rates.

On asset quality, the Governor acknowledged that non-performing loans have improved but remain above the desired benchmark. With credit growth expected to accelerate as rates fall, he emphasized the need for strong underwriting and sectoral risk assessment to avoid a build-up of bad loans.

To further strengthen the sector, the central bank will enhance its supervisory framework to include business model analysis, enabling early risk detection and timely regulatory action.

Dr. Asiama’s message signals a strategic shift for Ghana’s banks, urging them to move toward a more diversified and resilient business model, one that can weather shifting monetary conditions and foster deeper financial intermediation.

Source: Apexnewsgh.com