In the aftermath of the Domestic Debt Exchange Programme (DDEP), the Bank of Ghana (BoG) found itself grappling with significant balance sheet losses, a blow that raised urgent questions about its financial stability and future independence.

For months, the debate about how best to restore the Central Bank’s capital raged on, with Finance Minister Dr. Cassiel Ato Forson previously ruling out the use of taxpayer funds and instead championing internal restructuring as the path forward.

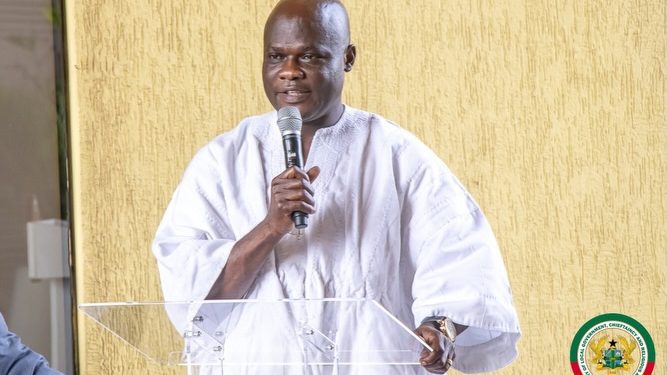

However, a shift in tone emerged at the 128th Monetary Policy Committee (MPC) press briefing, where Governor Dr. Johnson Asiama offered fresh insight into ongoing efforts to recapitalise the BoG. Addressing journalists, Dr. Asiama revealed that discussions with the government had been constructive and expressed confidence that state support would help repair the Bank’s battered balance sheet.

“I believe in the commitment of government to recapitalise the Central Bank following the hit it took to protect the economy amid the domestic debt restructuring programme,” Dr. Asiama stated, assuring that the collaborative approach was geared towards safeguarding the Bank’s policy credibility and operational independence.

The Governor emphasized that restoring the Central Bank’s capital was not just a matter of financial housekeeping; it was essential for ensuring the BoG could continue to deliver on its mandate of price stability, sound supervision, and effective macroeconomic management. “It is only fair that the wounds suffered as a result are addressed,” he noted, highlighting the importance of recapitalisation for maintaining confidence in Ghana’s monetary policy.

Dr. Asiama also pointed to broader signs of resilience in the financial sector. By the end of December 2025, 21 out of 23 licensed commercial banks had met capital adequacy requirements, with the final two given until the end of March 2026 to comply. “Overall, we have made significant progress on the recapitalisation strategy, and we are monitoring closely to ensure full compliance,” he concluded, signalling a renewed sense of stability and optimism for Ghana’s financial system.

Source: Apexnewsgh.com