The government has clarified that it spent GHS19 billion on the COVID-19 pandemic contrary to media reports.

This follows publications by some local media houses as well as a post by Member of Parliament for Yapei Kusawgu, John Jinapor, that per the 2021 budget statement, only GHS1.7 billion of the allocated GHS19 billion for issues of COVID-19 in 2020 was utilized.

Media reports also suggested that the rest of the money was used for expenditures unrelated to COVID-19.

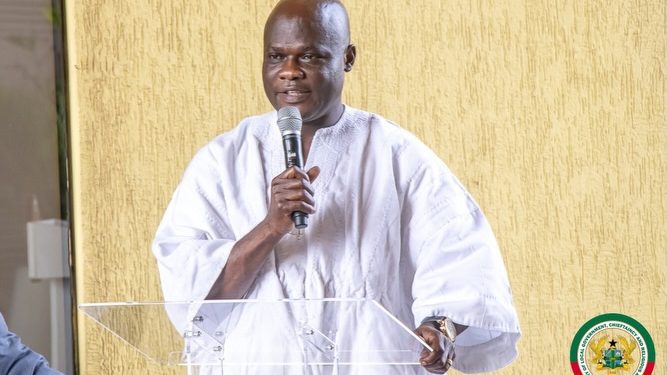

But speaking at a Press Conference, Information Minister Kojo Oppong Nkrumah, clarified that the amount quoted by the media was for just two items under the COVID-19 related expenditures.

“The GHS1.7 billion reflects expenditure on only 2 items under the COVID-19 related expenditure, paragraph 3 says, as at the end of December 2020 Ghana incurred revenue shortfall of GHS11 billion and expenditure increase of GHS14 billion. So if you are looking for the true fiscal impact, it is a combination of these two that will give you the true fiscal impact. The amount of GHS16.8 billion paragraphs 4 referred to under page 12 (b) is only providing information on the sources of financing and the fiscal gap resulting from the COVID-19 pandemic, so we encourage you to pay some attention to this one.”

Speaking at the same event, the Information Minister also explained that the COVID-19 Health Levy was not meant to pay for the free water and electricity given in 2020 to the citizenry.

“Government has never said that we have to pay for the free water and free electricity of 2020. The COVID-19 levy is not for free water and electricity. For the avoidance of doubt, the Ministry of Finance statement deals with it. But if you also go into the budget, if you go to I think page 58 in their statement, they said page 75 but its actually page 58 of the full document. It outlines the full uses of the COVID-19 levy. If I just may have the opportunity to share with you, it’s on page 58. It is all listed there. It never says anywhere that we have to pay for the free water and electricity of 2020, it outlines what the government has done so far in connection with the COVID-19 program, and then it goes on to make the point that to provide the requisite resources to sustain the implementation of these measures, the government is proposing the introduction of a COVID-19 health levy of 1% increase in the National Health insurance levy and 1% point increase in the VAT flat rate and for that purpose. We urge you to highlight the correct position as it has been put out by the Ministry of Finance.”

The minister, in an earlier interview, had indicated that the government’s proposed new taxes were to help address the huge fiscal gap created because of the government’s COVID-19 expenses.

The Caretaker Minister for Finance, Osei Kyei-Mensah-Bonsu in his 2021 budget presentation stated that the government will be introducing a COVID-19 Health Levy of 1% on VAT, Flat Rate Scheme (VFRS), and 1% on National Health Insurance Levy (NHIL).

However, clarifying his previous statement, the minister indicated that the levy was to among other things help in the procurement, distribution, and administration of COVID-19 vaccines.

Citinewsroom

Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0555568093