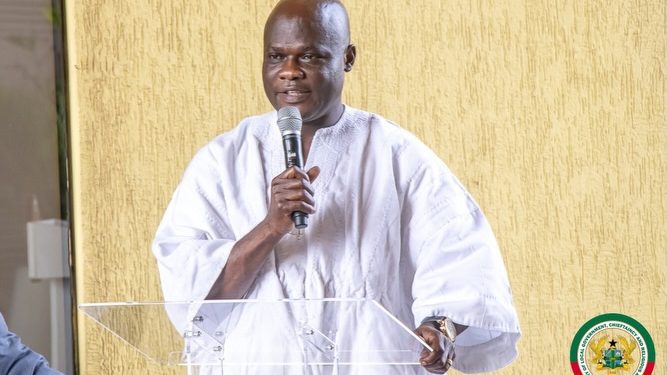

We can’t go back to IMF because we have a positive relationship with them—Yaw Buaben Asamoah

The governing New Patriotic Party (NPP) has revealed that the Akufo-Addo government is already implementing the measures that the IMF is likely to bring forward if the country decides to seek for an intervention. Apexnewsgh.com report According to former President John Dramani Mahama, the Akufo-Addo government should organize a national economic forum as an antecedent to returning to the IMF. Meanwhile, responding at a Press Conference organized in Accra on Wednesday, 9 February 2022, the Communications Director of the governing NPP, Yaw Buaben Asamoah condemned Mr. Mahama’s pronouncement. According to Mr. Asamoah, the former President John Dramani is castigating the government for not having a plan for fiscal consolidation that development partners will buy into, “but he says this without realizing that the development community have accepted the cost-cutting measures of 20percent in expenditure and E-Levy as the building block of our recovery”. “So, where is the lack of plan that he is mentioning, usually his focus is three things, increasing revenue internally, cutting waste and managing debt, these are the three prescriptions the IMF proposes,” Mr. Buaben Asamoa pointed. “So, at this stage for the former president to insist that we should go to a Senchi-like event where we will then march off to the IMF for relief, it doesn’t really work, we are already implementing the measures that the IMF is likely to bring forward.” “Having gone to the IMF and we are now struggling to fund roads including in the cities, we can’t go back to that and we will not go back to that because we have a positive relationship with the IMF already in terms of Article 4 consultation that we do annually, in our last Article 4 consultation the IMF stated clearly how we have dealt with COVID.” Apexnewsgh.com/Ghana/Ngamegbulam Chidozie Stephen

Government brought up E-levy to move beyond petroleum levy–Yaw Buaben Asamoah

The Director of Communications for the New Patriotic Party (NPP), Mr. Yaw Buaben Asamoah has said the government has brought up the E-levy in order to move beyond the petroleum levy. Apexnewsgh.com reports According to him, two things are visible, one is that a lot more Ghanaians will contribute to tax, which will make it easy for the government to function. He pointed, the government doesn’t function for profit, the government’s activities don’t generate profit for the government but they are things that give the opportunity for citizens to generate profit. Because when a government invests in a road, the road doesn’t bring the government profit but is the people who are using the road that government will tax some on their activity. Mr. Buaben Asamoah made the remarks during an exclusive interview with Apexnews-Ghana on Wednesday, December 8, 2021 He said, “Is very important that we appreciate that tax paying is not the easiest of things to do. However, government finances are driven by taxes and taxes can also be used to shape the economy in certain ways. So, the E-levy is a tax that is aiming to resolve so of the most difficult issues we have with taxation in Ghana. “The first of those issues is petroleum levy. You would realize that over the years, including the revolution time all that the government use to do was to tax petrol and anytime we taxed petrol, prices go up generally in the economy it doesn’t matter how much you put on the petrol price. So, the action of taxing petroleum has been saturated and because of the recent COVID issues with supply chain problems, you now find that even the petroleum itself price is going up worldwide. So, it is not attractive to taxes anymore. Because you cannot tax what the price is going up in the worldwide market and therefore, the government has decided to stop petroleum tax once and for all. “The other indirect tax, because we have to pay it back is loans, borrowing on the local market and borrowing on the foreign market and including in that borrowing is grants and concession from multi-literal institutions like IMF, WORLD BANK and also recently the commercial market which is BOND Market. The implications are that we never get enough money to invest in things we are borrowing for which are essentially infrastructure, roads and all the other needs and which is the principal and the interest thereon is growing up at a faster rate. And when you borrow to a certain point, you find out the interest payments are getting larger and larger and as we speak, the interest payment on our debt is hitting around 30% of our GDP. That means, for every Ghc 100.00 we get as a nation, we are going to use Ghc 30.00 to pay the debt. How much will be left for our work? So, borrowing too is no more an option, we can’t continue to borrow. So, we are at a point where we need a completely new strategy for funding our own personal needs, funding our roads, our schools, funding our hospital, funding our digital revolution, funding the things that will make us be able to move up and down, funding the digital economy itself, so that everybody can get access to the internet everywhere you are in Ghana”. “So, in order to move beyond petroleum levy, and move beyond borrowing, the government has brought up the E-levy. The E-levy means that the money which would have been put on petroleum taxes, which would have gone to borrow abroad is going to be taken from the E-transaction, which is transaction Ghanaians endorse in. “Two things are visible, one is that a lot more Ghanaians contribute to tax, which will make it easy for the government to function. But we know the government doesn’t function for profit, the government’s activities don’t generate profit to the government but they are things that give opportunity for citizens to generate profit. Because when a government invests in a road, the road doesn’t bring the government profit but is the people who are using the road that government will tax some on their activity. “So, when you put a tax on the E-levy two things happens, more Ghanaians will contribute to paying taxes which means we will pay smaller than before. “Currently, only those who are employed by the government are paying taxes. So, out of the 30 million Ghanaians, less than 10 million are paying tax. And it doesn’t fall on those people alone to be paying for all the roads, all the road re-payment and the money is not enough because they are few and we are taxing them more and more. So, we do this, that means a lot more Ghanaians will share the burden of paying the tax. So, if 11 million people are doing mobile phone transactions, the 11 million people will share and be paying the tax small small so that government can invest in our roads properly. “It also means that because a lot more people are paying, you don’t have to pay much individually. When few people are paying, they pay a lot, but when a lot more people are paying, they don’t have to pay too much as individuals because is spread across”. Mr. Asamoah told Apexnewsgh.com Apexnewsgh.com/Ghana/Ngamegbulam Chidozie Stephen Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your adverts and credible news publications. Contact: 05555568093