Ghana’s Finance Minister, Ken Ofori-Atta, has said he is working out modalities to resubmit the Electronic Transaction Levy (E-Levy) to Parliament for approval.

The tax E-Levy has been a controversial one since government presented its 2022 Budgets statement to the house in 2021.

According to him, the move will increase the country’s tax-to-GDP from 13% to a targeted 16% or more.

Minority insists that the 1.75% tax is a tool to exacerbate the plight of the ordinary Ghanaian, which the Covid-19 pandemic has already impacted.

A section of the populace and experts have also greeted the yet-to-be approved levy with disapproval.

The other components of the budget have been approved with the exception of the E-Levy which the Minority vows to fight vehemently.

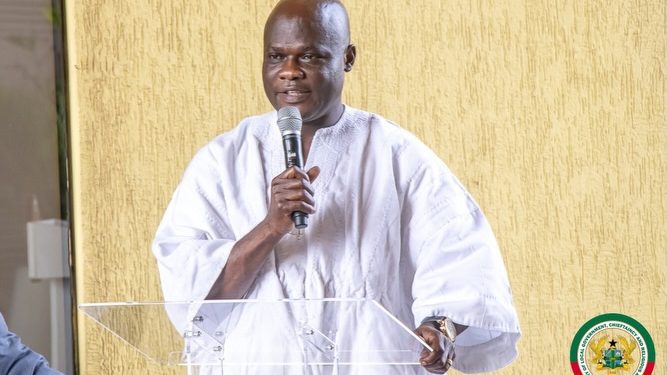

As Parliament prepares to reconvene on January 25, the Finance Minister has been clarifying some issues regarding the E-levy, which he hopes will clear the air ahead of the bill’s resubmission.

To drum home his justifications, the Minister listed many transactions that will be affected by the levy.

Addressing the media at the Ministry’s press conference on Wednesday, Mr. Ofori-Atta enumerated that it will encapsulate the following:

Mobile money transfers between accounts on the same electronic money issuer (EMI)

Mobile money transfers from an account on one EMI to a recipient on another EMI

Transfers from bank accounts to mobile money accounts

Transfer from mobile money accounts to bank accounts

Bank transfers on a digital platform or application which originate from a bank account belonging to an individual to another individual

The Minister subsequently highlighted some scenarios where the E-Levy will not apply. They are;

Cumulative transfers of GHC100 per day made by the same person

Transfers between accounts owned by the same person

Transfers for the payment of taxes, fees and charges on the Ghana.gov platform

Electronic clearing of cheques

Specified merchant payments (that is, payments to commercial establishments registered with the GRA for income tax and VAT purposes)

Transfers between principal, master agent and agent’s accounts

Citing Bloomberg’s report on Ghana’s economy, he said approving the e-levy would help address the issue of the downgrade of Ghana’s credit rating from B to B-.

Mr. Ofori-Atta also noted that the levy would be the driving force to move the country towards a more sustainable debt level.

The engagement forms part of a sensitization campaign geared towards getting the populace on board with the introduction of the levy.

The Minister says that from January 20, 2022, his outfit, “colleague ministers and other key members of government will embark on a public engagement and sensitization campaign across the country.”