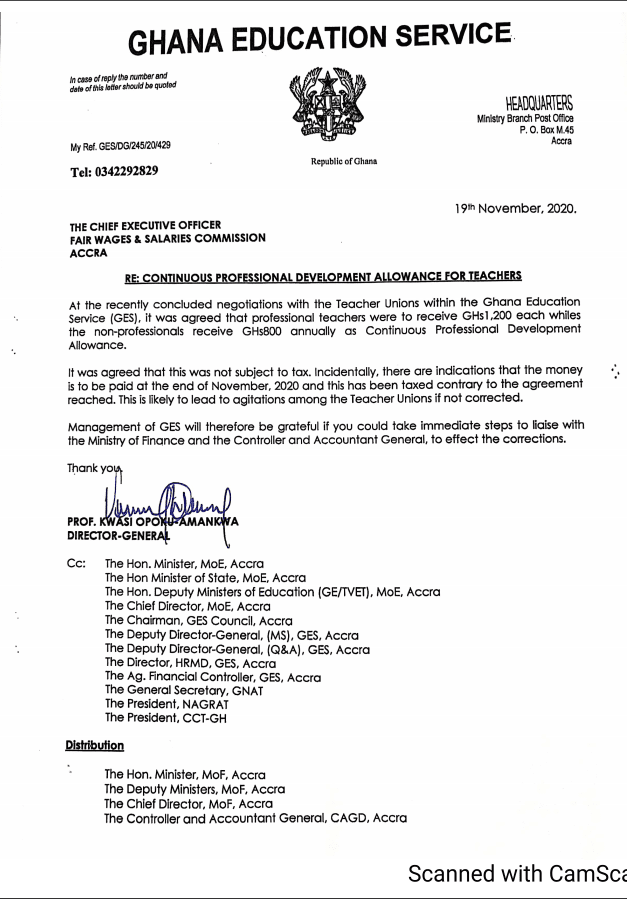

The Management of Ghana Education service has in a letter sighted by GhanaEducation.Org indicated that the Professional Development Allowance paid to teachers was not supposed to be taxed.

According to the GES, this was part of the agreement reached with the various stakeholders prior to the payment of the allowance.

In a letter to the Fair Wages and Salaries Commission, The Director-General of GES, Prof. Opoku Kwasi-Amankwa disclosed that the allowance was not supposed to be subject to tax deductions. However, the payments made to teachers were taxed which has led to agitations by the chalk fraternity across the country.

“It was agreed that this was not subject to tax. Incidentally, there are indications that the money … has been taxed contrary to the agreement reached.” The letter dated 19th November 2020 detailed.

The GES has therefore called the Fair Wages to take steps for the correction to avert further agitation among teachers. It further asked that the Fair Wages and Salaries Commission expedites action, liaise with the Ministry of Finance and the Controller and Accountant General, to correct the anomaly.

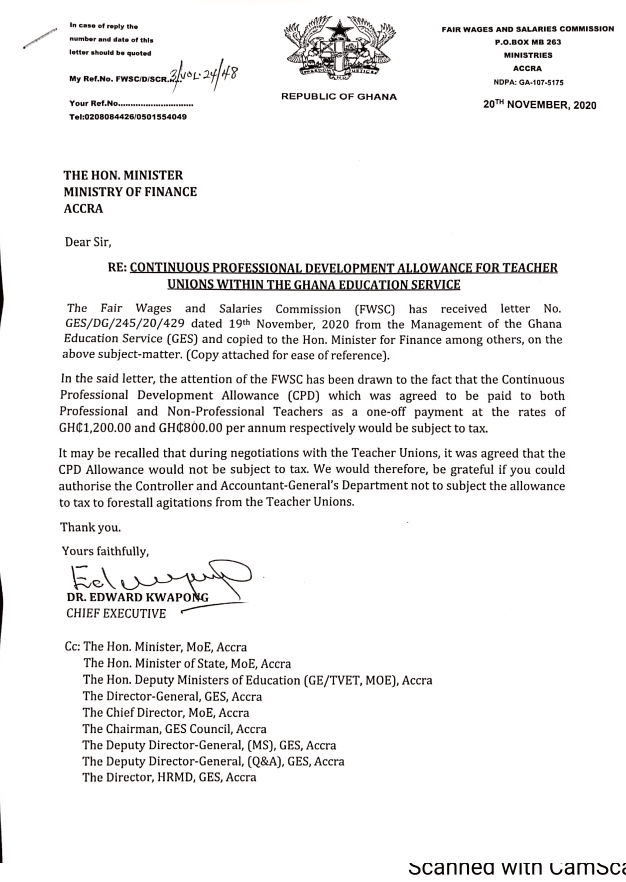

Taxed Professional Development Allowance Response from Fair Wages

The Fair Wages and Salaries Commission has responded to the letter and called on the Ministry of Finance to correct the error. It called on the MoF to take necessary actions to ensure the Controller and Accountant-General’s Department to correct the error.

“We, therefore, would be grateful if you could authorize the Accountant-General’s The department not to subject the allowance to a tax deduction to forestall agitations from the Teacher Unions.” The reply indicated.

Teachers who suffered about to 18% tax deduction on their allowances are hopeful that the necessary steps will be taken to credit their accounts with the deductions made on the Professional Development Allowance. The letters from the Ghana Education Service and the Fair Wages and Salaries Commission show that the allowance was not supposed to be affected by Section 4 subsection under 1a under the heading “The income shall be “the individual’s gains or profits from any employment for a Year of Assessment including allowances paid in cash or given in kind.” does not apply to the allowance to be paid once per annum to teachers. “General rules for taxation of income from employment quoted by GhanaEducation.org in our previous publication Tax on Teachers Professional Development Allowance Legal does not, therefore, apply to the professional allowance.

GhanaEducation.Org

Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publication