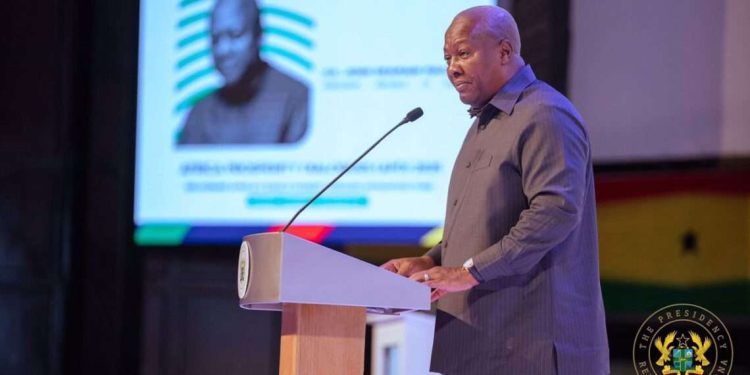

A draft report by the Constitution Review Consultative Committee (CRCC) recommends that the President of Ghana should pay tax on their salary and emoluments, setting an example for the rest of the citizenry. Apexnewsgh reports

This move would reflect the principle of equity before the law and align with the principles of law.

The report, presented at a stakeholders’ consultation meeting, suggests deleting Article 68 (5) of the Constitution, which exempts the President from paying income tax. The amendment would trigger consequential changes in the income tax law.

The CRCC, chaired by Clara Kasser-Tee, also recommends determining the emoluments of Article 71 holders using a pre-determined formula set by an independent emoluments committee. Additionally, the report proposes capping the size of Parliament at 277 and limiting the number of ministers a President can appoint to 25, with the deletion of the privilege to appoint deputy ministers.

These recommendations aim to promote transparency, accountability, and equity in governance. The report will serve as the foundation for a Sovereign National Conference to review the 1992 Constitution and obtain citizenry buy-in for potential amendments.

Source: Apexnewsgh.com

Thanks for reading from Apexnewsgh as a news publishing website from Ghana. We encourage you to freely share this story via social media platform and follow us on; Facebook on APEXNEWSGH-Tv or Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0248250270/0256336062.