Ghana’s Ministry of Finance has said it is confident parliament will pass the controversial e-levy this month once parliament reconvenes. In a statement, the ministry said “it is most unfortunate to note that foreign investors and market participants are on edge following the impasse in parliament, in relation to the passage of the E-levy Bill”. Parliament degenerated into mayhem in the dying embers of 2021 during a debate on the controversial 1.75% levy meant to affect most electronic transactions. The free-for-all brawl, as a result of a hung parliament, has left the levy, proposed in the 2022 budget, hanging. A recent article by Bloomberg said among other things that the era of cheap money draws to an end as bondholders are no longer prepared to cut Ghana any slack. It said the West African nation’s dollar bonds have slumped 10% in 10 days, moving deeper into distressed territory as investors judge that re-financing debt in the Eurobond market won’t be an option when the Federal Reserve hikes rates and budget targets remain elusive. The extra premium demanded on Ghana’s sovereign dollar debt, according to Bloomberg, jumped on Tuesday to an average 1,145 basis points, from 683 basis points in September while its $27 billion of foreign debt had the worst start to the year among emerging markets, extending last year’s 14% loss. Reacting to the article, the Ministry of Finance said: “The market seems to now be pricing into our bonds the perceived risks of having a slim majority in parliament and the consequences thereof”. Also, it noted: “The markets also seem to be concerned that this might impact the government’s ability to successfully pass and implement some of its major revenue policy measures as presented in the 2022 Budget”. The ministry said it would like to state that “a healthy debate in a vibrant parliament is a critical part of Ghana’s growing democratic credentials and by no means should it be deemed to be a fiscal risk”. It said the “government is confident that when parliament resumes sitting this month, the E-Levy Bill, which has already been discussed and approved by the Finance Committee of Parliament, will be passed”. Furthermore, the ministry said it wishes to state that the “government is on track to meet its non-oil tax revenue target for 2021 of GHS 57.05bn (13.16% of GDP)”, adding: “The 2022 non-oil tax revenue target of GHS 80.3bn moves us to tax revenue-to -GDP of approximately 16%, which is still below our medium revenue target of 18-20% of GDP”. “We are, however, confident that we can meet the 2022 revenue target and that the E-Levy will help us accomplish this”. Meanwhile, the ministry said the Bloomberg titled: ‘Ghana Debt Moves Deeper into Distress as Investors lose Patience’ was riddled with “serious factual errors” and reliant on “wrong historical debt-to-GDP figures”, which, if not corrected, could cause investors to have the jitters. “The Bloomberg article gave wrong historical debt-to-GDP figures”, adding: “It is essential we make the correction that Ghana’s debt-to-GDP figures, a decade ago, were 39.67% and 47.80% for 2011 and 2012, respectively, and not 31.4% as stated in the Bloomberg publication”. The Ministry of Finance said: “It is most unfortunate to note that foreign investors and market participants are on edge following the impasse in parliament, in relation to the passage of the E-levy Bill”. “The market seems to now be pricing into our bonds the perceived risks of having a slim majority in parliament and the consequences thereof. The markets also seem to be concerned that this might impact the government’s ability to successfully pass and implement some of its major revenue policy measures as presented in the 2022 Budget”. Read the full statement below: On Thursday, 13th January 2022, the attention of the Ministry was drawn to a widely circulated Bloomberg article captioned – “Ghana Debt Moves Deeper into Distress as Investors lose Patience”. There are some serious factual errors in the article, which may give investors some cause for concern, if not corrected. For example, Bloomberg stated 81.5% as the end-of-year debt-to-GDP ratio. This is incorrect. Our provisional nominal debt-to-GDP, as of the end of November 2021, was 78.4%, which is the latest data available. December’s revenue collections are seasonally the largest for any year, it is unlikely that our financing requirements in December will result in us exceeding 80% debt-to-GDP by December 2021. The Bloomberg article gave wrong historical debt-to-GDP figures. It is essential we make the correction that Ghana’s debt-to-GDP figures, a decade ago, were 39.67% and 47.80% for 2011 and 2012, respectively, and not 31.4% as stated in the Bloomberg publication. Again, it is important to note that for the period prior to the COVID-19 global pandemic, Ghana experienced an average debt-to-GDP ratio of 56.4% from 2015 to 2019. In 2020, Ghana’s GDP grew by 0.4% because of the impact of the COVID-19 Pandemic on the economy. Financing of the additional COVID-19-related expenditures, in addition to revised revenue targets, due to the impact of the pandemic, led to an increase in debt-to-GDP from 62.4% in 2019 to 76.1% in 2020. The current 78.4% debt-to-GDP ratio as of the end of November 2021 indicates rather a reduction in the rate of debt accumulation (i.e. declined by half to 18% as of November 2021 from 34% in 2020). This attests to an improvement in our debt and liability management, contrary to what the article seeks to suggest. Furthermore, with the positive primary balance target for 2022 – one of the key fiscal anchors in 2022 – Ghana should see improved stability and reduction in the debt-to-GDP ratio in 2022 and through the medium term. It is most unfortunate to note that foreign investors and market participants are on edge following the impasse in parliament, in relation to the passage of the E-levy Bill. The market seems to now be pricing into our bonds the perceived risks of having a slim majority in parliament and the consequences thereof. The markets also seem to be

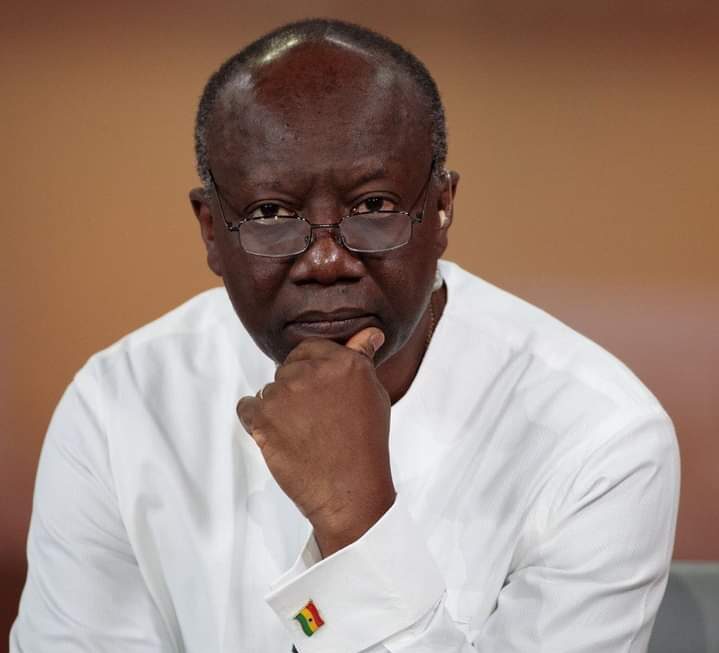

Ofori-Atta is overborrowing and we are not getting value for money–Kwame Pianim

Mr. Kwame Pianim said Finance Minister Ken Ofori-Atta “hasn’t done a good job” managing the economy, According to Mr. Pianim, “He is over-borrowing and we are not getting value for money”. “This government is borrowing as if there is no end”, Mr. Pianim said on Wednesday, 22 December 2021. “Somebody has to pay for it [borrowing]”, he said, explaining: “If you take a bond, I am not going to pay for it; my grandchildren are going to pay for it.” In his view, he believes the finance minister and the Akufo-Addo government have succeeded in dividing the country with the proposed 1.75 percent e-levy, which threw parliament into chaos on Monday night during a vote on it. “You managed to divide the country in a way that has never been so divided. Fisticuffs in Parliament; who is going to listen to you?” he asked. Mr. Pianim told TV3‘s New Day monitored by apexnewsgh.com on Wednesday, 22 December 2021 that Mr. Ofori-Atta “needs to realize that he is not just a budget and expenditure minister” but a Minister for Finance, which means “growing the economy.” Mr. Pianim also revealed that I tried sharing his thought but unfortunately Mr. Ofori-Atta does not pick his calls so he could share his thoughts with him on the economy. “The Finance Minister doesn’t take my phone calls,” he said. “Finance Minister doesn’t take my phone calls”, he stressed. “Even when I reached out to his personal assistants to book an appointment, he doesn’t give me an appointment”, he complained. “They know what they are doing”, he stated. Apexnewsgh.com/Ghana/Ngamegbulam Chidozie Stephen Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 05555568093

“Ofori-Atta failed to honor his end of the bargain–Kofi Amoabeng

Prince Kofi Amoabeng, co-founder of defunct UT Bank, has revealed that the Finance Minister Ken Ofori-Atta failed to honor his end of the bargain. According to Mr. Amoabeng, The Finance Minister defaulted badly on the repayment schedule. “The situation was so bad that they could only service the interest on the loan,” he revealed. Mr Amoabeng, whose bank was later collapsed under President Nana Akufo-Addo with Mr Ofori-Atta as Finance Minister, narrated in his book ‘The UT story: Humble Beginnings’, that “Ken and his partner, Keli Gadzekpo, came to me bearing their shares in Enterprise Insurance as collateral for a loan of about ¢5 million”. “At the time, the cedi had undergone redenomination and had been rebranded as ‘new Ghana cedi’. The ¢5 million he requested, therefore, was equivalent to about $5 million,” he pointed. Mr Amoabeng said, even though the duo did not meet certain requirements, he guaranteed they got the loan because of his close relationship with Mr. Ofori-Atta at the time. “We were very good friends, so, I felt obliged, albeit not without conducting the necessary due diligence. It was curious though that they did not prefer the banks where they would have secured the loan at a much lower annual interest rate as compared to our significantly higher monthly compounded interest rates”, he expressed. “Be that as it may, after I perused their documents, I felt it was acceptable to grant the loan. The only snag, and a significant one at that, was that the amount exceeded the Single Obligor Limit. Ideally, I should have declined their request there and then. Instead, I decided to bail them out,” he said “Unfortunately, Ken failed to honour his end of the bargain. He defaulted badly on the repayment schedule. The situation was so bad that they could only service the interest on the loan,” he revealed. “I became concerned because I had assured the board, I knew Ken very well and I was convinced beyond doubt that he would honour his word. Thus, I had egg on my face, especially as my partner had expressly stated his disapproval of the request,” he said. “I called a meeting with Ken and Keli and admonished them to do their best to pay up. I made it clear to them that I did not want my men to hassle them. Sefa Asante was the Credit Officer in charge of that portfolio. Because of my relationship with Ken and the respect I had for him, I prohibited Sefa and his team from applying our usual, rigid recovery methods. “In fact, I gave him express instructions not to ever hassle Ken and his team. They could check on them every now and then, but they had to be discreet about it. If they felt they were being stonewalled, they should not push back or react. Rather, they should revert to me on how to handle the situation,” he said. “Furthermore, to be double sure that Ken and Keli were not hassled, I devised a clever plan and informed them about it. Anytime the board exerted pressure on me, I invited them to a meeting, documented the meeting, and formally informed the board about it. It was all a ruse to hold the board at bay and buy Ken and Keli more time to pay up,” he added. “When the issue lingered, I reduced the interest rate to about 3% a month, just so they could settle their debt. Unfortunately, it took them over four years to pay up. Even then, they serviced it in bits and pieces until they were able to eventually pay up,” he revealed. Apexnewsgh.com/Ghana/Ngamegbulam Chidozie Stephen Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your adverts and credible news publications. Contact: 05555568093

2022 Budget full of Killer levies and taxes–Sampson Tangombu Chiragia

The Member of Parliament for Navrongo Central Mr. Sampson Tangombu Chiragia has described the E-transaction-Levy captured in the 2022 budget as a killer levy that is centered on a common person. The Navrongo legislator made the revelation during an exclusive interview with Apexnews-Ghana on Wednesday, December 8, 2021, the Navrongo Central legislator said, the region was neglected. According to the MP, the National Democratic Congress (NDC) is not against the tax because no country will develop without tax. But they are concerned about the innocent common person on the street struggling to get 3 square meals a day but are forced to pay what he described as a lot of levy and taxes’ Tangombu Chiragia further pointed that, they are not against Ofori-Atta coming to read the budget, because a budget is an estimate of what is supposed to be done for the development of this country. He explained, “…the issues we think the budget is not going to help a common person and as a social democratic party. You can understand that the budget is targeted to the common person and our aim is normally looking at the gap between the poor and the rich, but this particular budget is poorly centered. That’s why we are saying that there are certain issues that should be resolved so that, we can have the budget approved”. “Actually, there are a lot of taxes are centered on the common person, if you remember the 2022 budget, they were a lot of tax including borla tax and that is why today, the borla taxes are very high because of a number of taxes involved. The actual fuel price is not like we see it today but mostly about 42 to 48 percent are taxes, Ghanaians have already been taxed a lot. “Nobody is against tax, because without tax we cannot develop, but the taxes are a lot. The current Budget as we are talking about, if you look it very well, the benchmark values which we are all enjoying the discount of 50% at the port, they are withdrawing it. If they withdraw the benchmark it now means that all the cost of goods and services brought into this country will go back by a certain percentage. Because, if you are paying Ghc 50.00 for goods brought into this country, with the withdrawal of the benchmark you are now going to pay Ghc 100.00 and that will be passed to the common person and there are some other hidden taxes that people are not aware of”. “Before they came to power, the wholesalers and retailers are paid VAT flat. When you are a flat-rate taxpayer, it means that you pay only a cooperate levy of 1%, a flat rate taxpayer doesn’t pay GETFund levy and Health Insurance Levy totaling 5%. So, if they are moving you from a flat rate to a standard rate, it means you are now coming to pay the levy as high as 6%. So, those wholesalers and retailers whose annual income is more than 500.000 will have to pay the levies of 6% before VAT is put on top and NPP people think they are very wise. They don’t talk about tax, they talk about levies. “E-Levy is a killer levy, Imagine you are a teacher or a civil servant and they have transferred you from Bolgatanga to Accra and your wife and children are all in Bolga. Then, at the end of the day, your salary is not even enough, the government increases your salary by 4% annually and that 4% percent of Ghc 3000.00 which is about Ghc 120.00 and you are sending chop money of Ghc 1000.00 to your wife in Bolga for upkeep, which means you have to pay 1.75 percent. So, you can see, you are paying the tax again on income and that is now even the final tax is a levy”. Tangombu Chiragia explains Apexnewsgh.com/Ghana/Ngamegbulam Chidozie Stephen Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your adverts and credible news publications. Contact: 05555568093

Ofori-Atta is Ghana’s biggest pandemic since 2017 before Covid-19 – Isaac Adongo

Member of Parliament for Bolgatanga Central and Deputy Ranking Member on the Finance Committee in Parliament Isaac Adongo has fired back at Finance Minister Ken Ofori-Atta over the controversial E-levy proposal by the government. The Minister indicated that the government is still engaging stakeholders on the said tax to arrive at their final decision on the levy has been deemed as a mere political tactic which has no intention to adhere to the call by Ghanaians for the tax to be reduced. He accused the Minister of engaging in hiding and seeking on the issue and does not need the Minority caucus in Parliament before he heeds to the call of Ghanaians for a reduction. “Beyond the Minority, what does he have for the good people of Ghana? The country is not split into Minority and Majority. You don’t need the Minority before determining what is appropriate for the people of Ghana,” he said, noting that the government must listen to the concerns of Ghanaians and address them without deferring them to consultations with the Minority. The Finance Minister during a media briefing said the government will continue its engagements with the Minority caucus in the legislature and other stakeholders to get the proposed e-levy approved. “Having regard to its serious fiscal implications, we will continue our consultation with the Minority caucus in Parliament and other relevant stakeholders with the view to achieving consensus and reverting to the house in the shortest possible time,” the Minister stressed. He reiterated that the government will ensure that it will curb the issue of evading the payment of the tax. Despite assurances from the Minister, Mr Adongo appears not to be convinced that the government would change its position on the planned introduction of the 1.75% E-levy. He also accused Ofori-Atta of being disingenuous on the matter and causing a decline in the quality of democracy in Ghana. “Clearly they don’t’ want to move an inch from the E-levy. The Minister for Finance should be telling the people of Ghana what they have on the table. This hide-and-seek is an affront to democracy and an insult to Ghanaians. Don’t’ hide behind so-called negotiation. If it would have yielded any fruit, after two weeks you should have had results,” he said. “Clearly this is a man that is not being honest with us. And it is eroding everything that we have stood for as a democracy and I always say that Ken Ofori-Atta was the biggest pandemic from 2017 before we even got to know that there will be anything like Covid-19,” Isaac Adongo stressed. Apexnewsgh.com/Ghana/Ngamegbulam Chidozie Stephen Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0555568093.

Gov’t amends 2022 budget to suits Minority demands.

The Akufo-Addo/Bawumia led government, has amended the 2022 budget through the Finance Minister Ken Ofori-Atta considering certain demands already made by Minority Caucus in parliament. In a press conference organized on Monday, 6 December 2021, Mr Ofori-Atta revealed, that he has officially written to the Speaker of parliament concerning the modifications. “On behalf of the President, I have written to the Right Honorable Speaker of Parliament with details of amendments in response to emerging concerns by all stakeholders including the Minority Caucus”, Mr. Ofori-Atta pointed. Below are the modifications: Agyapa Royalties deal: We shall amend paragraphs 442 and 443 to take out references to mineral royalties collateralization. It is important to note that any reference to Agyapa was for informational purposes and, as such, was not reflected in the fiscal framework Tidal Waves disaster: In respect of the unfortunate tidal waves which rendered about 3,000 people homeless in Keta, we shall make the necessary budgetary allocations of at least GHS10 million to complete the Feasibility and Engineering studies for the coastal communities adversely affected. We will broaden the scope of the study to consider a more comprehensive solution to protect Ghana’s 540 Km of coastline, including the 149 Km between Aflao and Prampram. Meanwhile, NADMO has responded to the humanitarian crisis created by the tidal waves on the Keta coastline. Aker Energy transaction: We shall amend paragraph 829 of the 2022 Budget on the acquisition of a stake from Aker Energy and AGM Petroleum by GNPC, to reflect the resolution of Parliament dated 6th July 2021 that “the terms and conditions of the loan for the acquisition of the shares shall be brought to Parliament for consideration pursuant to article 181 of the Constitution; and Benchmark values: We shall avert any hardships to importers and consumers while safeguarding the interest of local manufacturing industries to secure and expand jobs for our people. This administrative exercise, which reviewed 43 out of 81-line items, has the objective to promote local manufacturing and the 1D1F policy, including the assembling of vehicles. It is important to note that this adjustment affects only 11.4% of the total CIF value, of which 50% is for vehicles. From our analysis, the potential increase in retail prices should be relatively insignificant and therefore inflation should be muted. The YouStart policy will also support our accomplished Traders with appropriate training and access to capital to become Manufacturers in order to expand the industrial base of our society and our import substitution strategy, in line with our Ghana Beyond Aid agenda. E-Levy: On the matter of the E-levy, having regard to its serious fiscal implications, we will continue our consultations with the Minority Caucus in Parliament and other relevant stakeholders, with a view to achieving consensus and reverting to the House in the shortest possible time. Mr Ofori-Atta noted: “We will work with the relevant Committees of Parliament to reflect these modifications in the 2022 Budget, as is the usual practice before the Appropriation Bill is passed. Any other concerns which may emerge shall be addressed during the discussions of the estimates by the Committees, as has been the tradition”. Following the stalemate over the budget, the Minority made five demands, which it said needed to be met before it could support the passage of the budget. Others includes: Suspend the Electronic Transaction Levy (E-Levy): The Government should suspend the E-Levy and properly engage stakeholders to agree on a reasonable policy. How can mobile money payments, bank transfers, merchant payments, and inward remittances be charged 1.75 per cent? The policy is not retrogressive, not pro-poor, and does not support the much-touted digitalization agenda and cash-lite economy that we all yearn for. Withdrawal of Agyapa: The NDC Minority will not support any collateralization of our revenues, particularly mineral resources. The future of our country will be bleak if we continue in that regard. We cannot jeopardize the future generations of our country just for our present desires. Provide for Tidal Waves Disaster: The Government should incorporate in its revised Budget adequate measures to address the issue relating to the Tidal Waves Disaster in Keta and other communities. The victims should be supported. And the Phase II of the Blekusu Coastal Protection Project must find space in the Budget. Properly re-construct the wording relating to the Aker Energy: Relating to GNPC acquisition of stake from Aker Energy and AGM Petroleum, the revised Budget should reconstruct paragraph 829 of the rejected Budget to reflect the decision of the House as captured on 6th August 2021 Votes and Proceedings of Parliament. 5. Review the Benchmark Value for Imports: Government should, in a revised Budget, reconsider paragraph 247 of the rejected Budget which sought to restore the Benchmark Values of imports by suspending the 50 per cent discount on selected General Goods and the 30 per cent discount on vehicles. Some concession should be given to the importers. Apexnewsgh.com/Ghana/Ngamegbulam Chidozie Stephen Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0555568093.

As for me, I think it should be reduced for ease of calculation–Nana Akomea

The 1.75% E-levy spelled out in the 2022 budget statement by Finance Minister Ken Ofori-Atta has generated a whole lot of controversies among the Ghanaian public since after the announcement. According to the government, the budget when approved will cover mobile money transactions, bank transfers, merchant payments, others. Speaking on this matter in a panel discussion on Peace FM’s morning show ‘Kokrokoo’ monitored by Apexnewsgh.com, a member of the governing party Nana Akomea said “the budget is yet to be approved and discussions are still ongoing…the 1.75% is not cast in stone…it’s possible it can be adjusted, but as for me ‘I think it should be reduced for ease of calculation’.” Meanwhile, he urged the government to be responsible and accountable because “Ghanaians will have no trouble paying any amount; once they know what the monies are being used for”. He pointed Apexnewsgh.com/Ghana/Ngamegbulam Chidozie Stephen Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 05555568093

I smelled a rat when i heard they mentioned scrapping of road tolls, i knew something bigger was coming–Asiedu Nketia

Asiedu Nketia, the General Secretary of the opposition National Democratic Congress (NDC) has ridiculed the 1.75% E-Levy electronic transactions declared by Finance Minister Ken Ofori-Atta during the 2022 budget to parliament. As soon as the 2022 budget is approved by parliament, all electronic transactions across Ghana will be charged. According to the Finance Minister, such move is to help gather revenue in the country. Meanwhile, Ghana recorded a total GHS500 billion from e-transactions in 2020 compared with GHS78 billion in 2016. Mr. Ofori-Atta explained, that government is charging an applicable rate of 1.75% on all electronic transactions covering mobile money payments, bank transfers, merchant payments and inward remittances, which shall be borne by the sender except inward remittances, which will be borne by the recipient. “It is becoming clear there exists an enormous potential to increase tax revenues by bringing into the tax bracket, transactions that could be best defined as being undertaken in the informal economy.” “Mr Speaker, to safeguard efforts being made to enhance financial inclusion and protect the vulnerable, all transactions that add up to GHS100 or less per day, which is approximately GHS3,000 per month, will be exempt from this levy,” he said. “Mr Speaker, this new policy also comes into effect once appropriation is passed from 1st January 2022. The government will work with all industry partners to ensure that their systems and payment platforms are configured to implement the policy,” he said. However, reacting to the step taken by the government, NDC General Secretary said, “…when they mentioned that they are scrapping road tolls, I said that there’s something bigger, something unpleasant that they are bringing on board”, indicating: “MoMo is now the game of the day it penetrates to the rural areas, the unbanked population; they use MoMo, so, if you are taxing that one and you’re rather cancelling road tolls whose incidence falls on vehicle owners, it means that it is not a pro-people budget at all. You don’t maximize revenue at the expense of people who are overtaxed”. Mr. Asiedu Nketia told journalists in parliament after the 2022 budget. Apexnewsgh.com/Ghana/Ngamegbulam Chidozie Stephen Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 05555568093

Ghanaians transacting business on MoMo to pay 1.75% levy – Ofori-Atta

As soon as the 2022 budget is approved by parliament, all electronic financial transactions in Ghana will cost extra Electronic Transaction Levy or in short ‘E-Levy’, as a strategy by the government to mobilize revenue. Apexnewsgh.com reports Finance Minister Ken Ofori-Atta revealed this on Wednesday, 17 November 2022 when he presented the 2022 budget to parliament. According to him, “It is becoming clear there exists an enormous potential to increase tax revenues by bringing into the tax bracket, transactions that could be best defined as being undertaken in the informal economy.” He further said, the government is charging an applicable rate of 1.75% on all electronic transactions covering mobile money payments, bank transfers, merchant payments and inward remittances, which shall be borne by the sender except inward remittances, which will be borne by the recipient. “Mr. Speaker, to safeguard efforts being made to enhance financial inclusion and protect the vulnerable, all transactions that add up to GHS100 or less per day, which is approximately GHS3,000 per month, will be exempt from this levy,” he stated. He stated that the E-Levy proceeds will be used to support entrepreneurship, youth employment, cyber security, and digital and road infrastructure, among others. “Mr. Speaker, this new policy also comes into effect once appropriation is passed from 1st January 2022. The government will work with all industry partners to ensure that their systems and payment platforms are configured to implement the policy,” he stated. Apexnewsgh.com/Ghana/Ngamegbulam Chidozie Stephen Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 05555568093

Kojo Oppong Nkrumah inspired Ghanaians to expect a good budget, yet Some Ghanaians believe the budget is Serwah…..

Information Minister, Kojo Oppong Nkrumah, has hinted Ghanaians to expect something good from the 2022 budget yet to be read by the Finance Minister Mr. Ken Ofori-Atta. Apexnewsgh.com report Mr. Oppong made the revelation through a post on his Facebook handle on Wednesday, November 17, 2021 According to him, you Ghanaians will smile. “Today is expected to be a good day for young Ghanaians looking for support to fuel their business ideas. We look forward to some relief for road vehicle users, while at the same time equitably raising revenues to speed up the fixing of our roads. Local industry can expect measures that will make their products more competitive while dealers benefit from the same measures to source the same products locally. And no, while acting as President of the Republic, VP Dr. Mahamudu Bawumia cannot join the finance minister to the chamber today. It will be out of place”. He posted However, some Ghanaians have different views. Accoding to them, the 2022 budget is going to be nothing more than ‘Serwaa-Broni budget’ Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 05555568093