The Ghana Real Estate Developers Association (GREDA) has expressed concern over the limited involvement of foreign developers in the association, describing it as a significant barrier to advancing its mission within the country’s real estate sector. Apexnewsgh reports

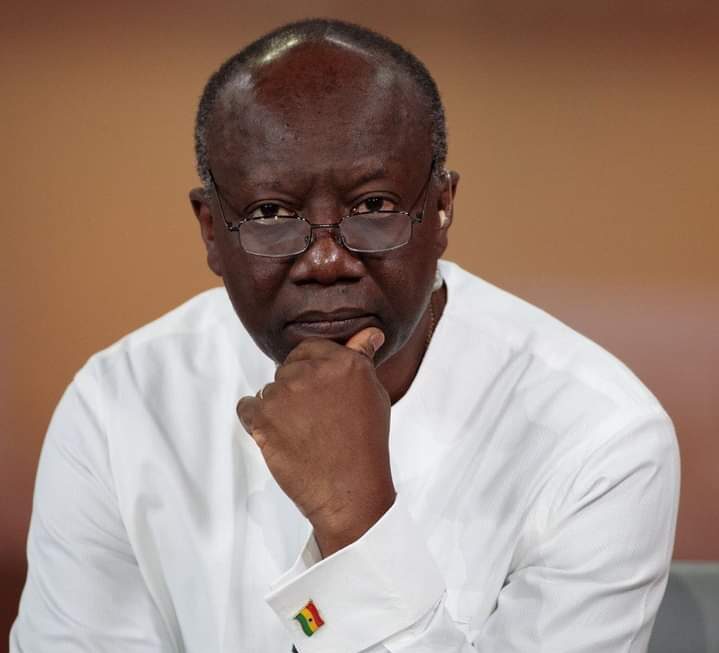

Speaking at the inauguration of GREDA’s Executive Council Standing Committees and Stakeholder Forum, the Association’s President, Dr. James Orleans-Lindsay, highlighted ongoing efforts to boost foreign developer participation—efforts that, so far, have faced considerable challenges.

Dr. Lindsay noted that despite the massive developments happening in the country, most major developers, particularly foreign companies, are not members of GREDA. “That is a problem. Despite our repeated efforts, they have either refused or shown no interest in joining GREDA,” he said. The Association’s investigations suggest that a substantial amount of liquidity is leaving the local system—capital that could otherwise support domestic developers and drive national growth.

The limited involvement of foreign developers has significant implications for local developers. Dr. Lindsay expressed concern that liquidity that could empower GREDA members to propel the country forward is being diverted. “It’s a serious issue. Liquidity that could empower GREDA members to propel the country forward is being diverted, and that’s deeply concerning,” he added.

Dr. Lindsay also addressed the issue of stagnant property prices despite the recent appreciation of the cedi against the dollar. “We continue to price properties in the cedi equivalent at the prevailing rate. However, prices of key inputs such as cement and iron rods have not declined accordingly,” he noted. Currently, a $100,000 property is valued at around ¢900,000, down from a peak of ¢1.6 million. Yet, developers have not adjusted their prices.

In a related development, Irene Odokai Messibah, Director of Policy Planning, Budgeting, Monitoring, and Evaluation at the Ministry of Works and Housing, announced that the ministry is reviewing the Rent Control Act and its Legislative Instrument (LI). The goal is to operationalize the Real Estate Agency Council Act, thereby creating a more favourable and transparent regulatory environment for the sector.

Source: Apexnewsgh.com