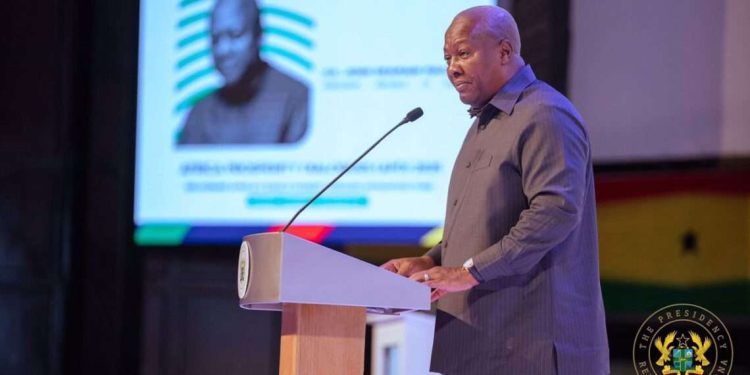

Ghana’s economy has begun to flourish once again, showcasing robust signs of recovery and growth in the first half of 2025. Apexnewsgh reports

The latest insights from the Bank of Ghana reveal a narrative of resilience, fueled by improved macroeconomic indicators across various sectors.

As the year unfolded, high-frequency indicators from the real sector hinted at a resurgence of economic activity. The first quarter witnessed a significant boost, largely propelled by a decline in inflation, a robust banking sector, and a strengthening cedi. By June 2025, the headline inflation rate dropped to 13.7 percent, a stark contrast to the 18.4 percent recorded in May. This marked the lowest inflation level since December 2021, reflecting efforts to stabilize prices amidst global economic challenges.

The central bank credited this positive trend to several factors, including improved supply conditions and relative stability in the exchange rate, alongside vigilant monetary policy management. These strategies have worked effectively to anchor inflation and foster a sense of economic security among businesses and consumers alike.

The banking sector, too, emerged as a beacon of stability, demonstrating remarkable resilience. The Bank’s Financial Soundness Indicators (FSIs) painted an encouraging picture, with signs of consistent asset growth and stronger solvency ratios. Liquidity improved, profitability surged, and operational efficiency reached new heights in the first half of the year. This strong banking performance underpins the broader economic recovery, giving businesses and households greater access to credit.

On the external front, Ghana’s performance shone brightly. The economy recorded a current account surplus of US$3.4 billion, its highest on record, during this period. Meanwhile, Gross International Reserves swelled to US$11.1 billion by the end of June, enough to cover 4.8 months’ worth of imports. The local currency, the Ghanaian cedi, showcased impressive gains against major international currencies, appreciating by 40.7 percent against the US dollar, 31.2 percent against the British pound, and 24.2 percent against the euro by late July. This remarkable strength was a clear signal of regained confidence in the cedi and the country’s macroeconomic stability.

In light of this encouraging economic landscape, the Bank of Ghana took proactive measures by reducing the Monetary Policy Rate by 300 basis points to 25.0 percent. This strategic move aims to further stimulate economic growth and ease credit conditions in the coming months, fostering an environment conducive to expansion.

These optimistic developments were discussed in depth during the 125th Monetary Policy Committee (MPC) meeting in July 2025, where the Bank reiterated its commitment to fostering stability while facilitating growth.

As Ghana continues on this path of recovery, the hope is palpable—opening doors to new opportunities for businesses and citizens alike while laying the groundwork for a resilient economic future.

Source: Apexnewsgh.com