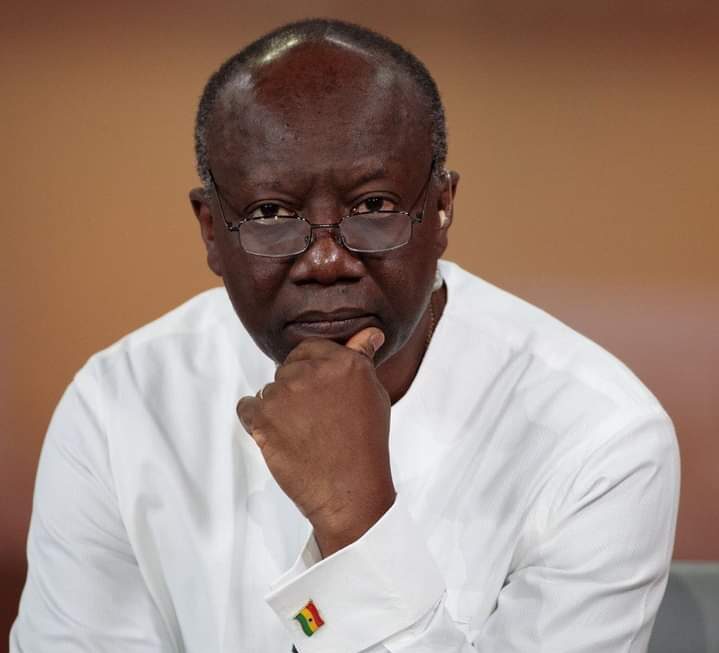

In a bold move that could potentially boost economic growth and competitiveness, the leader and founder of the Movement for Change, Alan Kyerematen, has pledged to implement the lowest tax regime within the Economic Community of West African States (ECOWAS) bloc if elected president in the upcoming December 7 polls. Apexnewsgh reports

During a meeting with the leadership of the Ghana Union of Traders Association (GUTA), Mr Kyerematen unveiled his vision for tax reform. He outlined specific measures aimed at achieving this goal, including consolidating the existing National Health Insurance Levy and Ghana Education Trust Fund levies into the calculation of a new Value Added Tax (VAT) rate.

Additionally, Kyerematen promised to abolish the Special Import Levy of 2% and the COVID-19 Health Recovery Levy. He also pledged to eliminate the Ghana Health Service Disinfection Fee on imports and exports. Furthermore, he vowed to abolish all taxes and charges on the importation of spare parts within two years of establishing a Government of National Unity.

To further alleviate the financial burden on importers, Kyerematen promised a review and consolidation of all statutory fees on imports imposed by regulatory agencies under a new Cash Waterfall mechanism.

The proposed reforms aim to streamline the tax system, reduce the tax burden on businesses and individuals, and promote economic growth and competitiveness. If elected, Kyerematen intends to prioritize these measures to create a more conducive environment for trade and investment in Ghana.

In concluding his meeting with GUTA, Kyerematen emphasized the importance of the trading community in Ghana’s economic landscape and stressed the need for all efforts to be deployed to make them more competitive.

Source: Ngamegbulam Chidozie Stephen

Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0256336062