The Controller and Accountant-General, Kwasi Agyei, has reaffirmed that all government institutions will be fully migrated onto secure electronic payment systems by the first quarter of 2026, as part of a nationwide drive to enhance transparency and efficiency in public financial management.

Speaking at a consultative meeting in Accra on Thursday, November 20, 2025, with Managing Directors of commercial banks, Mr. Agyei outlined the rollout of the Ghana Integrated Financial Management Information System (GIFMIS) and the Ghana Interbank Payment and Settlement Systems (GhIPSS) Electronic Funds Transfer (EFT) initiative.

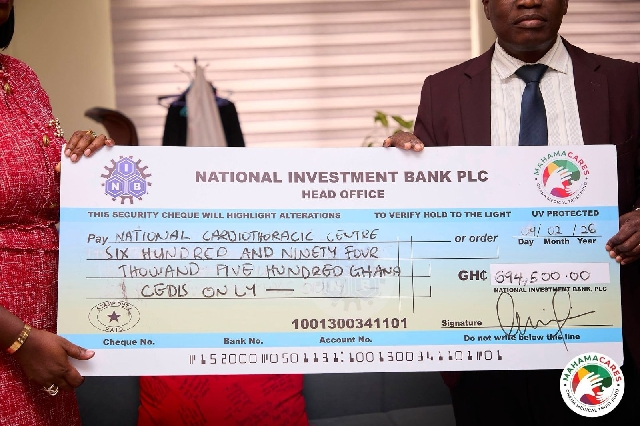

The engagement focused on deepening collaboration with banks, addressing outstanding concerns, and ensuring all stakeholders are adequately prepared for the integration. Mr. Agyei highlighted persistent challenges caused by the continued use of manual cheques within Ministries, Departments, Agencies (MDAs), and local government authorities, despite the Public Financial Management Act (Act 921) mandating GIFMIS as the approved public funds management system.

He warned that reliance on manual cheque transactions exposes government funds to fraud risks, complicates reconciliation, and breeds operational inefficiencies. “Failure to use the GIFMIS platform undermines integrity and transparency in financial management and affects the timely generation of financial reports for decision-making and preparation of the national accounts,” he stressed.

Mr. Agyei emphasized that eliminating manual cheques and adopting electronic payments is critical: “This initiative is not merely a technological upgrade; it is a transformative step toward strengthening accountability and efficiency in the management of public funds. Transitioning to electronic payments through secure platforms such as GIFMIS and GhIPSS is therefore both timely and essential.”

He added that meeting the 2026 deadline would significantly boost accountability, promote efficiency, and build public trust in government financial operations. The Controller and Accountant-General’s Department (CAGD) also announced that sensitisation and training programmes for government agencies would continue ahead of the full rollout.

Second Deputy Governor of the Bank of Ghana, Matilda Asante-Asiedu, reiterated the Central Bank’s commitment to digitising payment systems. She said integrating GIFMIS and GhIPSS would improve monitoring and accountability, and urged commercial banks to support MDAs and MMDAs in meeting the transition timeline.

Source: Apexnewsgh.com