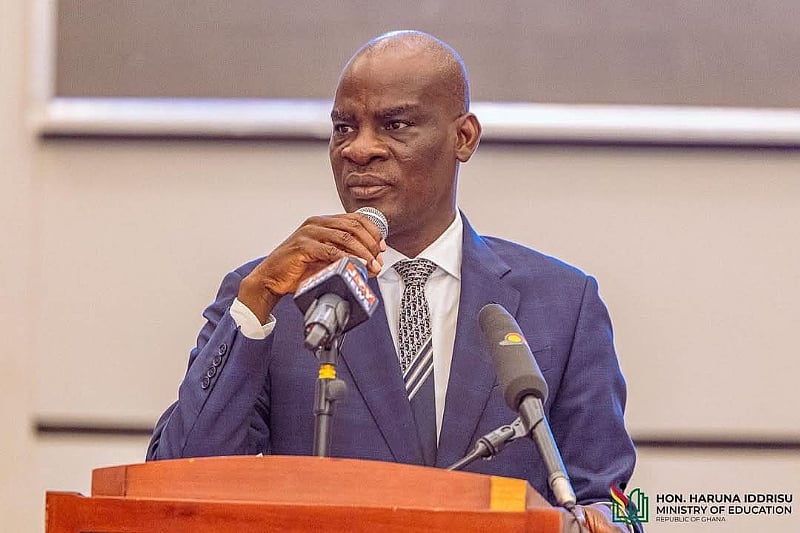

Former President John Mahama has urged the minority caucus to closely monitor the Bank of Ghana’s handling of the recent disbursement of $600 million by the International Monetary Fund (IMF). This disbursement is part of a $3 billion three-year extended credit facility approved in May 2023. Mahama expressed concerns about the Bank of Ghana’s role in exacerbating Ghana’s economic challenges by flooding the market with newly-printed currency. In a Facebook post, Mahama emphasized the need for responsible and judicious use of the IMF funds by the government. He called on the outgoing NPP government to exercise caution and urged other development partners like the World Bank to closely monitor the utilization of funds. Mahama assured the public that his party would closely scrutinize the government’s actions concerning the funds. The minority caucus, led by Cassiel Ato Forson, previously marched to demand the resignation of the Bank of Ghana’s Governor, Dr. Ernest Addison, and his deputies. They accused the Bank of printing GHS80 billion ($14.4 billion) illegally between 2021 and 2022, contributing to a hyperinflation rate of 54.1% in December 2022. The caucus alleged that GHS22.04 billion ($3.98 billion) of the printed money was used to support the government’s budget without parliamentary approval, leading to an increase in poverty levels. The Bank of Ghana denied these allegations, explaining that the referenced GHS22.04 billion was part of the total financing captured in the Mid-Year Fiscal Policy Review document. The central bank clarified that the losses and negative equity recorded were technical and related to accounting standards and expected credit losses from government debt. Governor Addison reminded Ghanaians that historical financial statements showed previous episodes of negative equity, which were resolved successfully. Governor Addison affirmed that the Bank of Ghana had enough income to cover operational costs and maintained sufficient capital. He highlighted that the Bank had complied with applicable laws and vehemently denied claims of annual financing of the government. He explained that financing had only occurred during the pandemic in 2020 and the crisis year of 2022, both within the boundaries of the Bank of Ghana Act. The Bank of Ghana stressed its commitment to managing operational costs and continued adherence to legal requirements. It reassured the public that its financial position would not negatively impact its operations. The Bank promised to reduce costs further and reassess the capital position in the year 2027. Former President Mahama’s calls for vigilance on the use of IMF funds reflects the ongoing scrutiny of the Bank of Ghana’s actions, as allegations of printing money without proper authorization contribute to concerns about the country’s economic stability. Source: Ngamegbulam Chidozie Stephen Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0256336062

8 unapproved Money Transfer Organizations listed by Bank of Ghana

The Bank of Ghana (BoG) has recently discovered that several Money Transfer Organisations (MTOs) operating in the Remittance and Ghana Forex Market are doing so without proper approval. These MTOs include LEMFI, WISE, TRANSFER GO, XOOM-A PAYPAL SERVICE, SENDVALU, BOSS REVOLUTION, BTC-AZA FINANCE, and SUPERSONICZ. According to the BoG, these organizations are in violation of Section 3.1 of the Foreign Exchange Act, 2006 (Act 723), which states that engaging in the business of dealing in foreign exchange without a license is illegal. However, by section 15.3 of the Foreign Exchange Act 2006 (Act 723), “each transfer of foreign exchange to or from Ghana shall be made through a person licensed to carry out the business of money transfers or any other authorized dealer.” “The Public, banks, Dedicated Electronic Money Issuers (DEMI) and Enhanced Payment Service Providers (EPSP) are by this Notice cautioned to desist from dealing with any of the institutions named above. “Approved MTOs are hereby reminded to terminate their foreign exchange flows through their partner institutions only and to adhere strictly to all guidelines in respect of their operations. “By this Notice, all market players are reminded of the directives above and entreated to comply accordingly. Non-compliance will result in severe sanctions including the withdrawal of the licence of the institution in breach,” a statement by the Bank of Ghana said. Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0256336062

Bank of Ghana Remains Focused on Achieving 8% Inflation Target– Dr. Leandro Medina

Dr. Leandro Medina, the International Monetary Fund (IMF) Resident Representative in Ghana, stated that the Bank of Ghana’s efforts to guide inflation back to its 8 percent target are not hindered by its participation in the Domestic Debt Exchange Programme (DDEP). The BoG’s involvement in the DDEP is part of a strategy to share the burden placed on the government and banks. In an interview with the B&FT newspaper, Dr. Medina explained that the IMF’s analysis indicated that the BoG can effectively execute its policy mandates, including bringing inflation back to its target gradually. He also mentioned that the BoG’s net equity is expected to improve over time and eventually become positive again. The BoG recently reported a loss of GH¢60 billion, attributing it to the depreciation of the local currency, impairment of loans and advances, and the impairment of the government’s securities holdings resulting from the Domestic Debt Exchange Programme. The IMF reiterated these reasons for the loss. In a recent statement, the International Monetary Fund (IMF) addressed the $3 billion bailout and provided answers to frequently asked questions. The Fund acknowledged that the Ghanaian authorities’ domestic debt exchange (DDE) plays a crucial role in their efforts to restore macroeconomic stability and ensure public debt sustainability. The IMF highlighted that the Bank of Ghana (BoG) is participating in the DDE to share some of the burden that it places on government debt holders, banks, financial institutions, pension funds, and individuals. However, this participation has resulted in a loss for the BoG, resulting in a negative net equity. Despite this, the IMF emphasized that the BoG will still be able to fulfill its policy mandates and work towards achieving the 8-percent inflation target. The IMF also reassured that the central bank’s income is expected to be sufficient to cover the operational costs related to monetary policy. Furthermore, they projected that the BoG’s net equity will improve significantly over time and eventually return. Source: Apexnewsgh.com/Ghana For publication please kindly contact us on 0256336062 or Email apexnewsgh@gmail.com

NPP Man described BoG exchange rate as a total scam

A well-known and recognized member of the governing New Patriotic Party Abubakari Ayuba has angrily described the Bank of Ghana exchange rate as a total scam. Apexnewsgh.com report Mr. Ayuba shared his sad experience after paying Ghc 12.3 for a dollar on Tuesday, January 3, 2023. Meanwhile, the Bank of Ghana exchange rate says, buying a dollar is Ghc 8.5717 and selling stands for Ghc 8.5803.Apart from Mr. Ayuba, most Ghanaians are crying out loud that despite the Bank of Ghana exchange rate, prices of goods are still skyrocketing in the various markets. Below is Mr. Ayuba’s post on Meta: This exchange rate is meaningless and a total scam unless the appropriate bodies is able to let it manifest in Reality. All transactions I’ve done both local and international in Dollars since this dollar drama have consistently been +3 or more of the Bank of Ghana Rate. Today I’m paying 12.3 for a dollar at the bank. So, where from this Rate? Source: Apexnewsgh.com/GhanaFor publication please kindly contact us on 0256336062 or Email apexnewsgh@gmail.com

UT Bank collapse: I think of jail – Kofi Amoabeng confesses

Chief Executive Officer for defunct UT Bank, Kofi Amoabeng says he sometimes thinks about jail. Kofi Amoabeng’s UT Bank was part of the banks that were closed down due to their liquidity issues and the utter disregard for Corporate Governance. Speaking in an interview with Accra-based Mx-24 monitored by MyNewsGh.com, he indicated that sometimes he thinks he will be given a jail term because of the issues with his bank. “Yeah,” he responded when asked if he thinks he will make a jail term. The businessman acknowledged that as a bank, a lot of mistakes were done indicating that “as human beings we are fallible”. Four companies belonging to Ibrahim Mahama took a loan of ¢261.4m from UT Bank with Dzata Cement receiving ¢131.5m. Lawyers for Ibrahim Mahama have disputed the figure but declined to state the amount taken. Addressing this issue, Kofi Amoabeng said he has never regretted giving out such monies to the brother of the former President of Ghana to start his business. “I don’t regret it,” the businessmen answered to a question on whether he regrets giving Ibrahim Mahama the loan. The Attorney-General (A-G) in February this year filed new charges at the Accra High Court against Prince Kofi Amoabeng, the founder of the defunct UT Bank, over the collapse of the bank. The charge sheet filed at the Accra High Court named as accused persons Dr. Johnson Asiama; a former 2nd Deputy Governor of the Bank of Ghana (BoG), Raymond Amanfu; a former Head of the Banking Supervision Division (BSD) of the BoG, Catherine Johnson; Head of Treasury of the UTBank, Robert Kwesi Armah; General Manager of Corporate Banking of UT Bank and UT Holdings; the parent company of UT Bank. All five have been charged by the State with forty-two (42) counts of fraudulent breach of trust, fabrication of evidence, deceit of public officer, fraudulently causing financial loss to the Republic, contravention of the Bank of Ghana Act and wilfully causing financial loss to the Republic. Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications