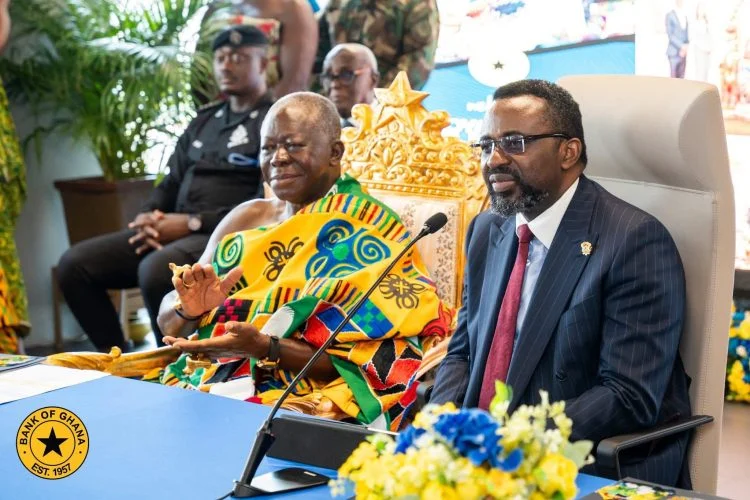

The hallowed halls of the Bank of Ghana this week became the stage for a critical national dialogue, one that pit urgent economic revival against the specter of returning inflation. The occasion was a high-profile courtesy visit by the Asantehene, Otumfuo Osei Tutu II, but the conversation swiftly turned from ceremony to substance. With the gravity of his office and the voice of a nation’s entrepreneurs, the revered monarch issued a direct and powerful plea to Governor Dr. Johnson Asiama: lower the cost of borrowing, and do it now. “The private sector is gasping for breath,” his message resonated, cutting to the heart of the nation’s economic tightrope. “Let me be as blunt as I can: no amount of investment by government can give us a sound economy. This moment calls for a private push.” He challenged the central bank to engineer a fundamental shift: “Move the economy from the crippling high interest rate regime to a level where it becomes a stimulant of business and job creation.” For the countless small and medium-sized enterprises (SMEs), this was a long-awaited royal endorsement of their daily struggle. Governor Asiama, custodian of the nation’s price stability, received the call with measured understanding. He stood on a platform of hard-won gains, a historic drop in inflation to 5.4%, robust international reserves soaring above $13.8 billion, and money market yields in retreat. The 91-day Treasury bill rate had already fallen from 13.4% to 10.3% in a single month. “My prayer and wish,” the Governor shared, revealing a personal ambition aligned with the nation’s need, “is that by the end of my four-year tenure, lending rates will not be more than 10 per cent.” Yet, between that wish and the Asantehene’s demand lies a perilous path. The cautionary voice of global consultancy Deloitte echoed in the background of their discussion. While acknowledging the BoG’s successful 10-percentage-point rate cut in 2025, which stabilized the cedi and contained prices, Deloitte warned that excessive easing in 2026 could undo that very progress. “Excessive easing could risk reversing the progress made in controlling inflation,” their analysis stated, a stark reminder of the balancing act. Early signs in 2026 offer a glimmer of hope. The key Ghana Reference Rate has dipped slightly, and average bank lending rates have begun a slow descent from 26.6% to 24.2%. They are movements in the right direction, but for the Asantehene and the business community, they are mere footsteps on a journey that requires leaps. As the meeting concluded, the central challenge for 2026 was crystallized. The Bank of Ghana must now choreograph a delicate dance: unlocking the credit needed to fuel a private-sector-led recovery, without missing a step and reigniting the inflationary fires it just spent a year extinguishing. The trajectory of interest rates is no longer just a monetary policy metric; it is the defining economic story for the year ahead. Source: Apexnewsgh.com

Ghana Unveils Framework for Ethical Banking

The landscape of Ghana’s financial sector is on the cusp of a transformative shift. In a landmark move, the Bank of Ghana (BoG) has officially unveiled the operational guidelines for Non-Interest Banking (NIB), opening the door to a new era of ethical finance and deeper financial inclusion. This culmination of years of strategic planning is widely credited to the steadfast efforts of BoG Governor, Dr. Johnson Asiama, and the Advisor on Non-Interest Banking and Finance, Professor John Gatsi. The finalized guidelines provide a clear and robust regulatory roadmap, building upon an earlier exposure draft to ensure operators function within strict prudential standards. The excitement within financial circles is palpable. Rumors are swirling of at least five existing conventional banks preparing to apply for dedicated NIB “windows” by the end of January, while several large new investors are lining up to establish full-fledged non-interest banks. This dual-application system is a core feature of the framework, designed to encourage both innovation and stability. The comprehensive guidelines establish a solid foundation for this new banking model: Governance & Expertise: Licensed NIB Institutions (NIBIs) must form a Non-Interest Banking Advisory Committee (NIBAC) of experts in banking, law, and NIB principles to ensure all products are ethically sound and risks are managed. Integrity of Operations: For conventional banks offering NIB through a “window,” a strict separation is mandated. They must operate a separate Non-Interest Finance Fund (NIFF), ensuring these ethical funds are never mixed with conventional banking funds. Inclusive & Voluntary: The BoG emphasizes that NIB is open to all Ghanaians, irrespective of religious belief, and participation is entirely voluntary. Capital & Compliance: Capital requirements align with existing standards, while NIBIs must maintain liquidity through Shari’ah-compliant instruments, steering clear of interest-bearing securities. Tax Clarity Pending: The guidelines acknowledge the crucial issue of tax neutrality, with a resolution expected from a joint team coordinated by the Ghana Revenue Authority (GRA). The implications stretch far beyond bank branches. The BoG is collaborating with the Securities and Exchange Commission (SEC) to develop a harmonized framework for non-interest capital market instruments. This paves the way for the future introduction of Sukuk (ethical investment certificates), which promise to unlock new, shari’ah-compliant capital for Ghana’s critical infrastructure projects. By integrating Ghana with the global non-interest finance industry, this initiative promises to diversify the financial sector, promote resilience, and revolutionize how finance serves the real economy. Welcome to the new, inclusive chapter of banking in Ghana. Source: Apexnewsgh.com