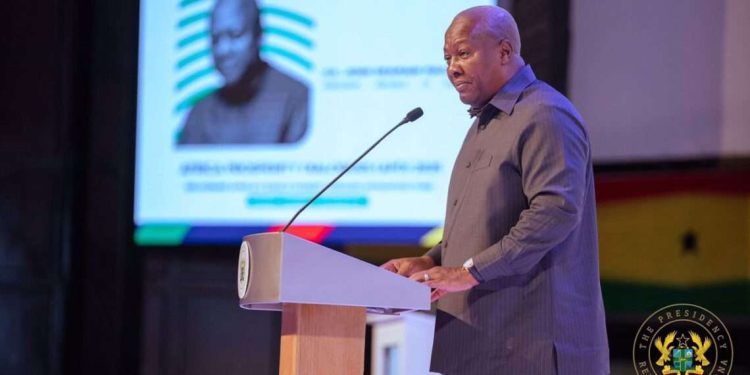

Ghana’s Ministry of Health wants to digitise records in all of Ghana’s public and (religious) mission-owned hospitals and clinics and thus make paper folders for patients a thing of the past. The idea is good, and the plan itself is very old, but serious attempts to execute date back to 2007, culminating in a detailed national e-health strategy in 2010. Among other aims, the overall strategy today encourages the development of an ecosystem of software and ICT innovations to support Health Systems Management across the nation. Different systems being able to talk to each other (interoperability); local development, deployment and support of solutions; and minimising the financial burden on the state through private participation, are some of the core principles of Ghana’s e-Health policy. Although the policy does not rule out the use of foreign software, it nevertheless impliedly supports the development of local solutions for obvious reasons of job creation, local support, and preservation of local medical records in Ghana. On June 28, 2021, the honourable Minister caused a letter to be written by the Director-General of the Ghana Health Service to the entire senior management corps of Ghana’s frontline health services presenting the Lightwave Health Information Management System (LHIMS) as the only authorised Electronic Medical Records (EMR) solution for all government-run and religious mission-operated hospitals (about 20% of the facilities in the national “public health sector” are managed by religious organisations). The Minister is genuinely proud of LHIMS and its vendor, Lightwave eHealth Solutions, a small organisation based in Atlanta with mail handling services in the UK and a couple of project managers in Ghana. So proud that he is fond of reciting the success stories of LHIMS’ deployment in the Central Region, as in a recent testimonial: “Presently 25 health facilities including the Cape Coast Teaching Hospital are online and active. This covers 345 Doctors and 2,312 clinical staff across the region. Twenty Network Radio Masts have so far been installed. So far 379 computing devices have also been deployed.” What is left unsaid is that in recent years, a number of major hospitals, such as Komfo Anokye Teaching Hospital, have been forced to abandon locally developed EMR solutions like HAMS for LHIMS, thereby increasing the latter’s footprint. To get LHIMS entrenched in the Central Region, for instance, HAMS, a competing local product, literally had to be ripped out of places its frugal and longsuffering Ghanaian developers had spent years cultivating to even accept the idea of medical records digitisation. It must be mentioned that local developers in the space built their platforms on their own dime, and had to pay for all the development and testing themselves. They had to prove themselves capable and compete in the market before they could pass due diligence by the public and private hospitals buying their products and services. They have since had to ensure high levels of service to retain these clients. Lightwave has never had to deal with such hurdles. Yet by one fell swoop, the Ministry’s directive, if carried out to the letter, would lose just one of these local EMR vendors as many as 200 clients they have acquired over a period of more than a decade. It should be reasonable to expect that our government officials will support successful local initiative and companies more than foreign ones especially when the foreign vendors do not have a superior product or service. The fact remains that, even with all its touted successes, LHIMS is not a perfect solution. A 2019 study by Princess Gloria Ofori and her colleagues revealed that whilst the LightWave system has indeed reduced waiting time at the Outpatients Department (OPD) of the University of Cape Coast Hospital by 50%, nearly half of the staff (41%) are unable to generate the relevant performance reports from the system. The main reason why LHIMS is displacing all other solutions in the EMR space like those implemented well before it was brought into the country by the likes of IPMC, Queauji (builders of the well-regarded Carewex health IT platform), Progsoft, Spagad, Sanford, Infotech, MedData, and Africa eHealth Solutions etc is simply Ministerial fiat. When these hardy local technology vendors have scraped and penny-pinched to make some headway in a tough market, a bureaucrat in Accra will step into the fray to fight on behalf of Lightwave, forcing customers to abandon solutions they have built a level of comfort with. This is seriously damaging local ICT companies in droves. The Sampson Djaba-founded Lightwave is to be commended for having succeeded in obtaining strong buy-in at the Ministry of Health to modernise the country’s medical records system, but the truth is also that it does not have the capacity to replace the large number of ICT companies currently offering health IT solutions, especially in the EMR segment, to public and mission-run facilities. But even if it did, it is clearly against established policy of interoperability and resilience from having multiple vendors and a diverse ecosystem, as against a single vendor and a single point of failure across the entire health technology landscape. Monopolies are out of fashion everywhere and no good policy allows the creation of single providers who the whole system will soon be entirely reliant on, and thereby create negative dynamics for performance and efficiency as happens with all monopiles. It is clearly more desirable to allow for competition and diversity and ensure standards that create seamless interoperability. An interoperable model will lead to a virtuous cycle of vendors improving their systems in order to be more preferred, and those who slack are likely to be replaced. In the end, users and ultimately patients are the beneficiaries of operationally effective and cost-effective systems and services. This also leads to the development of local capacity and the creation of high-quality jobs in ICT. A credit check report we have seen shows that Lightwave’s reported annual revenues have been under $300,000 in recent years for its Atlanta-based holding entity and also that its full-time employees number less than

- +23356336062

- apexnewsgh@gmail.com

- Upper East, Ghana

Hot News