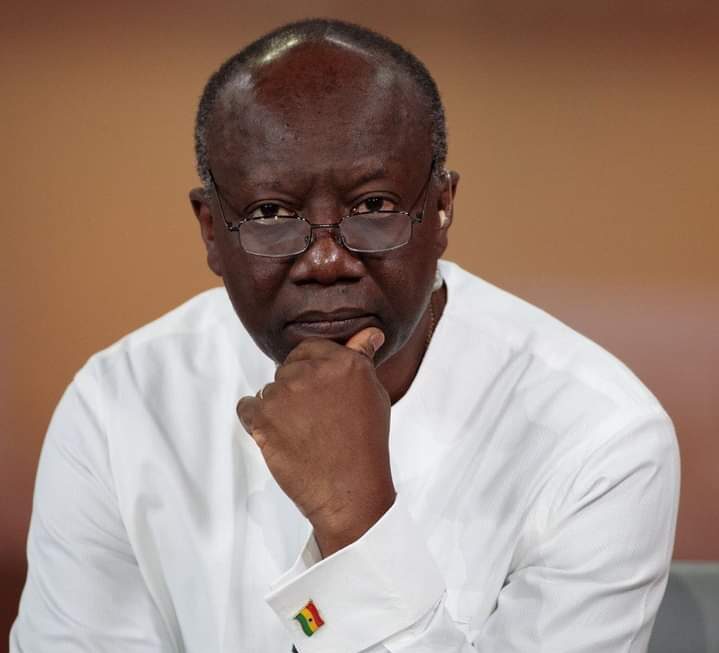

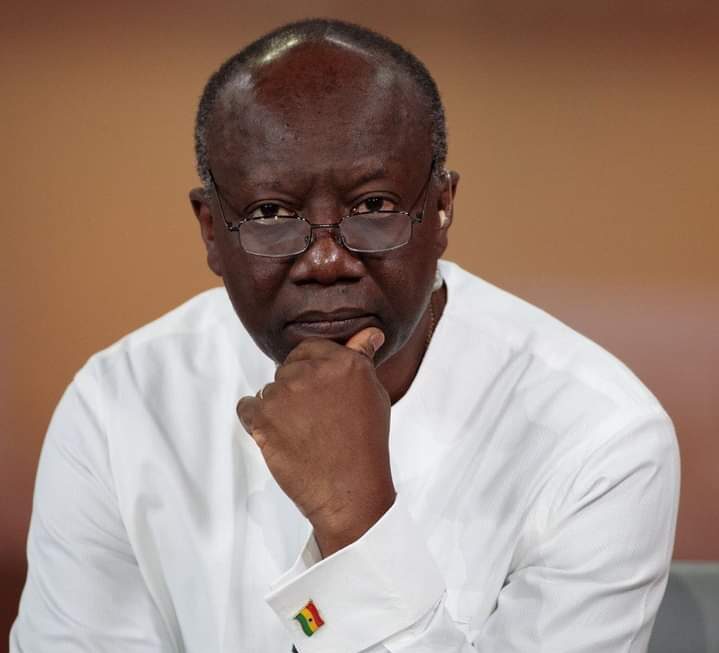

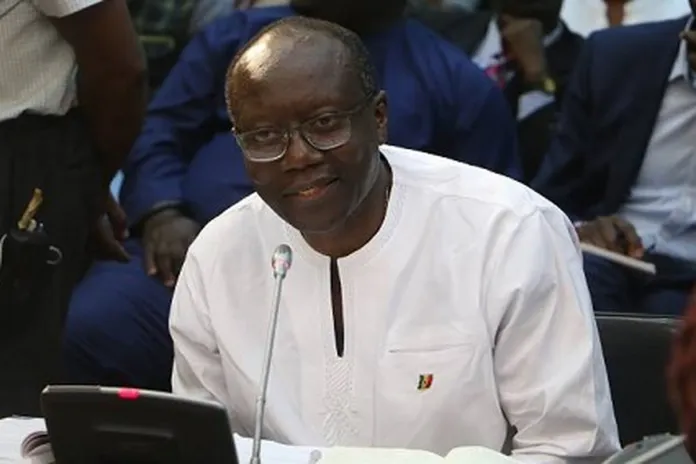

Ken Ofori-Atta Appointed as Senior Presidential Advisor and Special Envoy Amid Speculation

In a surprising turn of events, former Finance Minister Mr. Ken Ofori-Atta has been appointed to a new role as Senior Presidential Advisor and Special Envoy for International Finance and Private Sector Investments. This move comes after his recent departure from the position of Finance Minister, sparking widespread speculation among Ghanaians in the days following his exit. Rumors and conjecture swirled around the fate of Ken Ofori-Atta following his departure from the Finance Ministry, with many eager to learn about his next steps in the government. Today, a significant development emerged as an appointment letter, dated February 15, 2024, and authored by Chief of Staff Hon. Akosua Frema Osei-Opare, surfaced on social media. The appointment of Ken Ofori-Atta to the role of Senior Presidential Advisor and Special Envoy for International Finance and Private Sector Investments sheds light on the government’s continued trust in his capabilities and expertise. His wealth of experience in finance and investment is expected to play a crucial role in advancing Ghana’s interests on the international stage and fostering partnerships within the private sector. As Ghanaians digest this latest development, the appointment of Ken Ofori-Atta to this strategic role underscores the administration’s commitment to leveraging top talent and experience in pursuit of national development goals. The detailed appointment letter provides a glimpse into the responsibilities and expectations associated with his new position, signaling a new chapter in his distinguished career in public service. With Ken Ofori-Atta’s appointment as Senior Presidential Advisor and Special Envoy, the government sends a clear message about its focus on international finance and private sector investments as key drivers of economic growth and prosperity. As he takes on this new challenge, Ghanaians will closely watch his contributions and impact in shaping the country’s economic landscape in the years to come. Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: +233256336062.

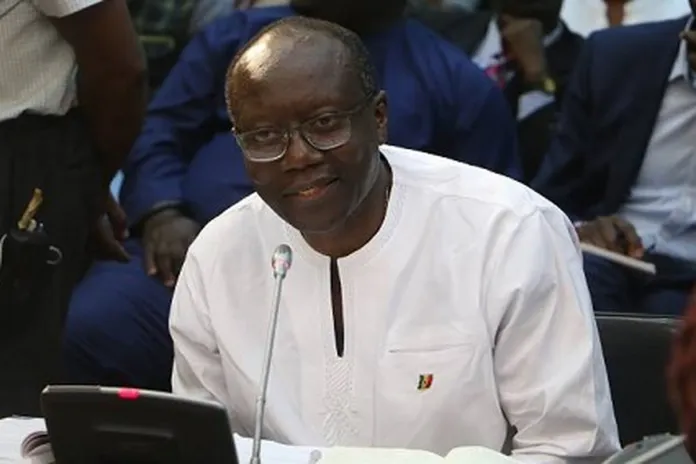

Ofori-Atta unhappy with Parliament’s rejection of 2024 budget

Finance Minister Ken Ofori-Atta has criticized the involvement of Parliament in approving or rejecting a budget statement, referring to it as an “unnecessary intervention.” This statement comes after a walkout by the Majority in Parliament over the approval of the 2024 budget, which led to the suspension and adjournment of the sitting. Speaking at the Ghana Capital Markets Conference, Ofori-Atta questioned the need for such drama during the budget passage and suggested that disagreements should focus on appropriation issues rather than the budget statement itself. He argued that Parliamentary approval should only be required for the principles and objectives of the budget, and not for the specific details. Ofori-Atta emphasized that a budget aimed at macro stability, relief for the people of Ghana, and economic growth would likely receive widespread support. He concluded by suggesting that the issue of appropriation and estimation should be the focus of judgment, rather than the approval of the budget statement itself. Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0256336062

Ofori-Atta pleads with minority to approve budget, says this is time for peace

Minister for Finance Ken Ofori-Atta, during the opening ceremony of the Post Budget Workshop in Parliament, has urged the minority to avoid repeating the resistance they displayed towards the Electronic Levy (E-levy) three years ago. The controversial levy resulted in the rejection of the 2021 budget, which was later overturned in the absence of the speaker of Parliament, Alban Bagbin. Ofori-Atta emphasized that given the current situation in the country, it is important for the minority to refrain from opposing the proposed measures in the 2024 budget. “Mr. Speaker, there is a time and season to tear and a time to mend, there is a time for war, a time for peace and a time to scatter and a time to gather. Mr. Speaker this is the time to gather, this is the time to mend and also a time for peace,” the Finance Minister pleaded. The Finance Minister revealed that the government aims to raise 0.9% of GDP through revenue bills that will be presented to parliament for approval. Speaker Bagbin also stressed the importance of considering public sentiment during budget deliberations, stating that this year’s budget is particularly critical for the welfare of the people. Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0256336062

2024 Budget: 8 reliefs to be implemented next year by government

The Finance Minister, Ken Ofori Atta has announced some tax reliefs in the 2024 budget statement which will be execute by government in 2024. Before to the 2024 budget statement, there has been several calls by various stakeholders which has to do with the scrapping of certain taxes to help alleviate the present overwhelming cost of living. There were campaigns against taxes including those on sanitary pads, COVID levy and several others. During the presentation by the Finance Minister, on Wednesday November 15, 2023, he pointed out eight reliefs which is expect to implement in 2024. The 2024 budget, which was dubbed ‘Nkunim’, to wit, victory in the Twi language, was to project the path toward fiscal consolidation, macro stability and growth that began a year ago, according to Ken Ofori Atta. Kindly read the publicized tax reliefs: Extend zero rate of VAT on locally manufactured African prints for two(2) more years; Waive import duties on import of electric vehicles for public transportation for a period of 8 years; Waive import duties on semi-knocked down and completely knocked down Electric vehicles imported by registered EV assembly companies in Ghana for a period of 8 years; Extend zero rate of VAT on locally assembled vehicles for 2 more years; Zero rate VAT on locally produced sanitary pads; Grant import duty waivers for raw materials for the local manufacture of sanitary pads; Grant exemptions on the importation of agricultural machinery equipment and inputs and medical consumables, raw materials for the pharmaceutical industry; A VAT flat rate of 5 percent to replace the 15 percent standard VAT rate on all commercial properties will be introduced to simplify administration. Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0256336062

No deadline has been set by the IMF for the second tranche disbursement–Mins of Finance

The Ministry of Finance has disregarded claims that Ghana missed the 1 November 2023, deadline for the disbursement of the second tranche of the US$3 billion bailout package from the International Monetary Fund. A statement released by the Ministry on Friday, November 10, 2023, says that there is no timeline, for the release of the second tranche of the IMF funds. According to the statement, “No deadline has been set by the IMF for the second tranche disbursement, which is due to take place after the IMF executive board approves the first review.” The explanation came after a misleading publication on myjoyonline, which claimed that Ghana had missed a purported deadline for the disbursement of the IMF funds due to delays in external debt restructuring. The Ministry of Finance sought to set the record straight and dispel any misinformation about the disbursement timeline. Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0256336062

Ofori-Atta got it all wrong with BoG’s ‘phenomenal growth – Minority

The accusation from the minority caucus against Finance Minister Ken Ofori-Atta suggests that he used incorrect figures to praise the Bank of Ghana’s performance in his recent article. According to the minority caucus, Ofori-Atta incorrectly used nominal figures to claim that the Bank of Ghana significantly increased its assets between 2016 and 2022. In their counter article, titled ‘Should Citizens Stand With the Bank of Ghana Governor Who Has Aided the Government’s Economic Management Team to Destroy Livelihoods? The Position of the Minority in Parliament,’ the minority caucus highlights this alleged error and questions the credibility of the Bank of Ghana governor’s involvement in the government’s economic management, which they claim negatively impacted people’s livelihoods. Read the minority’s full article below: SHOULD CITIZENS STAND WITH THE BANK OF GHANA GOVERNOR WHO HAS AIDED THE GOVERNMENT’S ECONOMIC MANAGEMENT TEAM TO DESTROY LIVELIHOODS? THE POSITION OF THE MINORITY IN PARLIAMENT In a recent statement intended to justify the gross incompetence and misgovernance of the leadership of the Bank of Ghana, the Minister of Finance, Ken Ofori-Atta sought to “speak for” the Bank of Ghana but ended up worsening the case of the central bank and deepening its credibility crisis. Ordinarily, the beguiled statement by the Minister should be disregarded entirely and treated with the contempt it deserves. However, there is the need to correct some of the key misconceptions peddled and to fact-check the assertions made by the Minister in the statement. From the second paragraph, the Minister erroneously used nominal figures to argue that the Bank of Ghana had grown its assets phenomenally between 2016 and 2022. If the Minister describes a 2.4-fold increase from GHS53 billion in 2016 to GHS125.97 billion in 2022 as phenomenal, how would he describe the increase in Bank of Ghana’s assets by 8.2-fold during the period of the NDC government (2009-2016) when the same assets grew from GHS6.45 billion as at end-2008 to GHS53 billion as at end-2016? What is even worse is that the increase in assets between 2016 and 2022 were largely driven by the illegal monetary financing of government; in other words, illegal lending to government. This excessive printing and lending of money to government is the cause of the economic woes the country is currently facing (high inflation, volatility in the exchange rate, and high interest rates) as confirmed by the IMF and the World Bank. In the third paragraph, the Minister again used nominal GDP figures to argue that the size of GDP had more than doubled in value from GHS219.6 billion in 2016 to GHS610.2 billion in 2022, without adjusting for the impact of inflation within the same period. The Minister must realize that nominal values will always rise, hence the right thing to do is to express these in real terms. On the watch of this Minister, real GDP growth slowed between 2018 and 2020 and only recovered slightly in 2021 due mainly to revenues from the three oil fields they inherited as well as the massive covid-19 revenue inflows, and not due to any special expertise of the Minister. Again, the Minister’s management of the economy worsened in 2022 and it is projected to further deteriorate at the end of 2023 with growth projection of 1.5%. In the same paragraph, the Minister also touted doubling revenues since 2016, with total revenues increasing from GHS32 billion in 2016 to GHS96.7 billion by 2022. Again, for the comparison to be meaningful, these nominal figures must be expressed in real terms. At best, these figures should be expressed as a ratio of GDP, or in other words movement of the revenue-to-GDP ratio. Indeed, data from the Ministry of Finance shows that revenue to-GDP on the watch of this Minister has not performed well as he claims. Even in 2015, and with all the challenges faced by the economy then, revenue to GDP was 13.2%. Given all the resources that this government has received, including two additional oil 2 wells, government’s revenue to GDP is just about 12.1%. The fiscal deficit on his watch actually increased in spite of the covid-19 revenue windfalls, hence his claim of increasing revenues over the period is inconsistent with what happened to government expenditures. In paragraph 6, the Minister spoke about resetting the financial architecture since 2017. The question is what the cost of doing so has been, and whether the exercise could not have been handled more prudently and at a much lesser cost and with minimal disruptions in the financial architecture. In paragraph 7, the Minister took another wrong dive stating, “However, as many central banks, including Bank of Ghana, moved away from pursuing quantitative targets of monetary policy towards price targets, dominance of the central bank’s balance sheet as the key metric has waned in many economies and in academic literature as well”. This is entirely incorrect, both in practice and in theory. The central bank’s balance sheet remains critical in the implementation of monetary policy, hence liquidity management is at the core of this function. If the Minister had appreciated the workings of monetary policy, he would have known that despite the move from monetary targeting to inflation targeting, liquidity management or the ability to control the central bank’s balance sheet remains an integral part of monetary policy implementation. The Minister must also know that the use of price targets does not mean that monetary aggregates no longer matter. They still do matter in monetary policy implementation and therefore excessive central bank financing still matters for monetary policy. In paragraph 8, the Minister simply re-echoed the Bank of Ghana’s earlier argument that it was normal for a central bank to operate with negative equity, and that its losses recorded in 2022 would not affect its operational efficiency. These industrialised countries cited in the paragraph did not underwrite any insolvency of their governments which caused such losses. The pandemic and the Russia/Ukraine war rather provided windfall revenues to the government of Ghana, and hence cannot be a reason in the case

Restoring macroeconomic stability in progress—Ken Ofori-Atta

Finance Minister, Ken Ofori-Atta has said the government has made progress in restoring macroeconomic stability of the country. Mr. Ofori-Atta said whiles addressing Parliament during the mid-year budget review on Monday July 31, 2023, The Minister stated that government set out to achieve key macroeconomic targets for 2023 namely Overall Real GDP growth of 2.8 percent; Non-Oil Real GDP growth of 3.0 percent. He further mentioned, end-December inflation rate of 18.9 percent; Overall budget deficit of 5.9 percent of GDP (on commitment) and 7.7 percent on cash basis; Primary Balance (Commitment basis) of a surplus of 0.7 percent of GDP and deficit of 1.1 percent of GDP on cash basis; and Gross International Reserves to cover not less than 3.3 months of imports. “As I have indicated, we have made significant progress on restoring macroeconomic stability and the narrative is changing. The economy is showing signs of recovery. The exchange rate has stabilised, inflation has softened, and interest rates have declined since December, 2022. “Mr. Speaker, these outturns are the result of focused implementation of all the measures we presented in the 2023 Budget and the positive sentiments arising from the progress with the IMF Programme, which I will now discuss,” Mr. Ofori-Atta stated. Apexnewsgh.com/Ghana Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0256336062

2022 my most difficult year as Finance Minister-Ken Ofori Atta confessed

Ghana’s Finance Minister Ken Ofori-Atta has described the year 2022 as his “most difficult” year in office. Mr. Ofori Atta who was presenting the mid-year budget review to parliament on Monday, 31 July 2023 that on 1 July 2022, confessed that they took what was then a very difficult but necessary decision to request support from the IMF to implement our Post-COVID-19 Programme of Economic Growth (PC-PEG). He acknowledged the country was going through a difficult period of economic uncertainties and despondency. He said, “We have turned the corner and, more importantly, we are determined to continue down that path. Soon, we expect the measures taken to result in economic activity greater than anything experienced in the history of the Fourth Republic”. “our plans and programmes should soon lead to a sustained increase in domestic production, including manufacturing and farming, replacing many of the products that we are used to importing”. According to the Finance Minister, when he presented the Budget in November 2023, he indicated that they would pursue major fiscal and monetary policy measures within the framework of the PC-PEG – our coordinated response to the macro-fiscal challenges, which H.E the President charged us to develop in March 2022, before going to the IMF – thus the PC-PEG. He further said, “Parliament passed the revenue, and expenditure measures as well several other macro-critical economic policies we presented in the 2023 Budget, and we are grateful for that”. “Along these lines, we also needed to create additional fiscal space by i. negotiating an International Monetary Fund (IMF) Programme; ii. Concluding a debt operations program; and iii. Attracting significant investments (especially green investments) for a vibrant growth strategy.” “I can now report that we have been diligent and resolute in implementing these measures and successfully: i. Negotiated the US$3 billion 3-year IMF-ECF Programme, which was approved on 17th May, 2023 to support the implementation of our PC-PEG. ii. Concluded on February 14th the initial part of the Debt Operations, of which the Domestic Debt Exchange Programme (DDEP); iii. Developed a framework for the V20 Climate Prosperity Plan to attract climate investments from the private sector; and iv. Initiated the Mutual Prosperity Dialogue to crowd in domestic and external private investment to underpin our growth strategy”. Apexnewsgh.com/Ghana Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0256336062

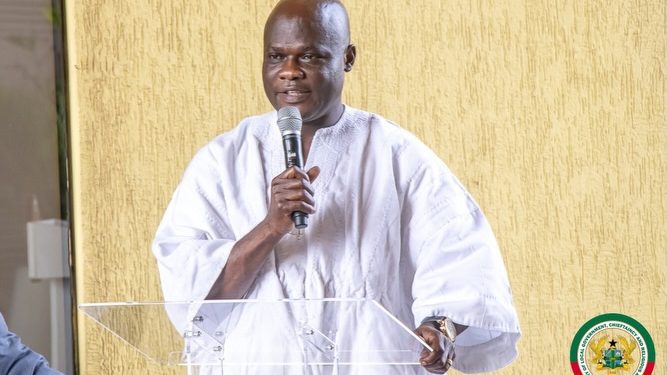

Contingency Fund now stands at GH¢200 million — Finance Minister

The Contingency Fund, into which money voted by Parliament shall be paid and utilised, currently has a credit balance of about GH¢200 million, the Minister of Finance, Ken Ofori Atta, has said.. The amount is out of the total amount of GH¢1.33 billion that Parliament voted between 2017 and 2022 for the Fund. That, he said, included GH¢1,203,715,086, GH¢50,000,000, and GH¢76,489,307 voted in 2020, 2018 and 2017, respectively. “Of the total GH¢1,330,204,393 voted for the Contingency Fund, GH¢1,203,715,086 was paid from the Stabilisation Fund to meet COVID-19 related expenditures in 2020. The amount represented the cedi equivalent of the $200 million in excess of the $100 million cap established for the Stabilisation Fund,” he said. Replenishing fund In a statement read on his behalf on the floor of Parliament yesterday, Mr Ofori Atta said the government advanced and utilised an amount of GH¢1,201,911,778 from the Contingency Fund between 2020 and 2021 to meet COVID-19 related expenditures. He gave the breakdown as 2020 (GH¢1,200,696,496) and 2021 (GH¢1,669,387). “As of December 31, 2021, the balance in the Contingency Fund account was GH¢660,117,959. The Ministry of Finance, the Controller and Accountant General’s Department and the Bank of Ghana are working together to replenish the account over the medium term as indicated to this House in April 2020,” he said. Mr Ofori Atta’s statement was read by the Minister of State at the Ministry of Finance, Dr Amin Adams, in response to a question by the National Democratic Congress(NDC) MP for Ketu North, James Klutse Avedzi. The MP had asked how much had been voted by Parliament and paid into the Contingency Fund, how much advances had been made from the fund since 2017 to date and how the advances made from the Fund had been utilised. Commitment to transparency The finance minister said the government had demonstrated commitment to transparency and accountability in the use of public funds by proactively complying with legal provisions governing the public finances. “With respect to accountability for funds from the Contingency Fund to primarily meet COVID-related operations, we have demonstrated unparalleled transparency,” he said. He said the Auditor-General, in accordance with article 187 of the Constitution and upon “my request in July 2022”, had conducted a comprehensive audit of all COVID-19 expenditures and sources of funds, including the Contingency Fund, covering the period March 2020 to June 2022. The report, the minister said, had subsequently been submitted to Parliament in a transmittal letter dated December 30, 2022 and subsequently referred to the Public Accounts Committee. Source: Apexnewsgh.com/Ghana For publication please kindly contact us on 0256336062 or Email: apexnewsgh@gmail.com Greater accountability Under President Nana Addo Dankwa Akufo-Addo, Mr Ofori Atta said, Ghanaians were enjoying greater accountability and transparency in the management of the public purse than any other period under the Fourth Republic. “Since 2017, the government has complied with the reporting provisions in the Public Financial Management Act 2016 (Act 921), including Budget Implementation reports, Fiscal Reports, Annual Public Debt Reports and Petroleum Revenue Management Reports. “Mr Speaker, we are building a responsive culture of transparency and accountability in public financial management,” Mr Ofori Atta said. Graphic

Keep your promise and fire Ofori-Atta after successful IMF deal – Ablakwa to Akufo-Addo

Member of Parliament for North Tongu, Samuel Okudzeto Ablakwa, is urging President Akufo-Addo to keep his promise to Ghanaians and fire his cousin, the Finance Minister, Ken Ofori-Atta after cinching the $3billiion IMF deal. It is recalled that the Majority caucus in Parliament called for Mr Ofori-Atta to be sacked but after meeting the President, the caucus in a statement dated 26th October 2022, revealed that the President asked them to stand down until Ghana’s negotiations with the IMF were concluded. On Wednesday, 17 May 2023, the executive board of the IMF approved the $3 billion bailout allowing for an immediate disbursement of about $600 million. Following the successful conclusion of the deal, Mr Ablakwa is asking if President Nana Akufo-Addo will consider the request of his members of Parliament. In a Facebook post, the North Tongu MP said “After an embarrassing IMF U-Turn deal, Ghanaians expect President Akufo-Addo to keep his promise by firing his cousin, Ken Ofori-Atta — who is now widely regarded as Ghana’s most disastrous Finance Minister.” “Will the President attempt in this instance to be a man of his word”? he quizzed. Prior to this new reminder, several calls on the President from a section of Ghanaians and civil society organisations for Mr Ofori-Atta to be fired due to the difficult economic conditions fell of deaf ears. —Classfm—