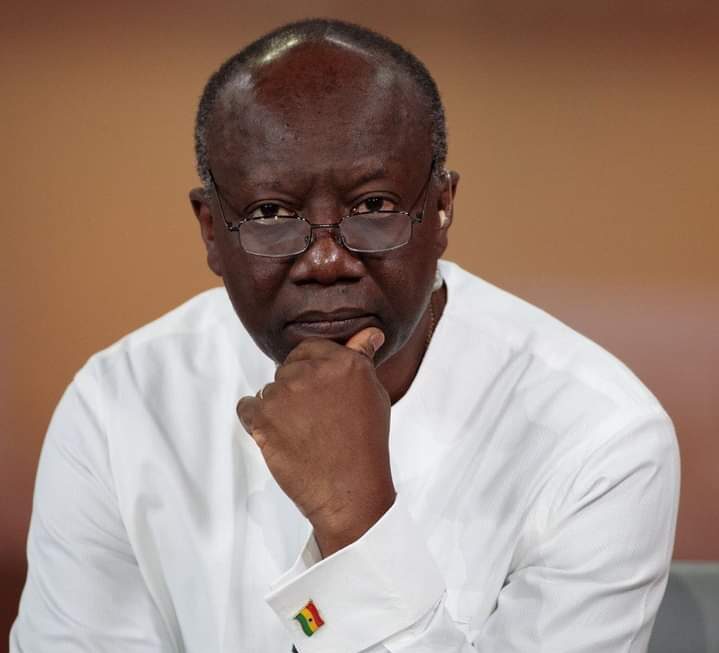

The Governor of the Bank of Ghana (BoG), Dr. Johnson Asiama, has sounded a strong warning about the rampant smuggling of large sums of foreign currency out of the country, a development he described as a serious economic threat and a major hindrance in Ghana’s fight against money laundering.

Dr. Asiama revealed that recent intelligence reports have uncovered shocking instances: individuals carrying over a million dollars in cash out of Ghana without any declaration. “People are carrying over a million dollars just out of Ghana without declaring these; those are leakages,” he stated.

Dr. Asiama emphasized that the Bank of Ghana, in collaboration with the Ghana Revenue Authority (GRA) and other agencies, is now stepping up efforts to trace such funds, verify their sources, and ensure that regulations on currency declarations are strictly enforced. “That’s critical for our anti-money laundering fight,” he stressed.

To address these challenges, Dr. Asiama explained that the central bank has issued new market directives aimed at closing existing loopholes and boosting the efficiency of Ghana’s financial system. “We are redefining the framework within which the market has to work. These are things we should have been enforcing earlier, but given the context, we now see the need to set clear boundaries so that the markets can function properly,” he explained.

Brushing aside criticisms that the BoG’s actions are excessive, the Governor likened the new regulations to setting fair ground rules for a football match: “There’s a context within which the game has to be played, and that’s exactly what we are doing.”

Dr. Asiama also addressed the controversial notice on large cash withdrawals, revealing that central bank investigations had uncovered questionable practices among some corporations. “Imagine a corporation wanting to withdraw $10 million over the counter. Their payments are abroad, and they don’t carry physical cash to settle anything.

So we said no, such corporations must operate differently,” he said. For individuals, however, Dr. Asiama assured the public that small withdrawals would not be affected. “If you need $100 or $200 for personal use, you can negotiate with your bank. You have the choice of taking the cash, paying a commission, or converting it into cedis,” he clarified.

Highlighting the collaborative approach, Dr. Asiama noted that the central bank had worked closely with commercial banks before rolling out the new directives. “We met with the CEOs of banks several times, took on board their feedback, and issued the notices with their input. That’s why the banks are not complaining—they were part of the process,” he said.

Dr. Asiama expressed confidence that these new measures will foster accountability, protect the nation’s economy, and reinforce Ghana’s anti-money laundering regime.

Source: Apexnewsgh.com