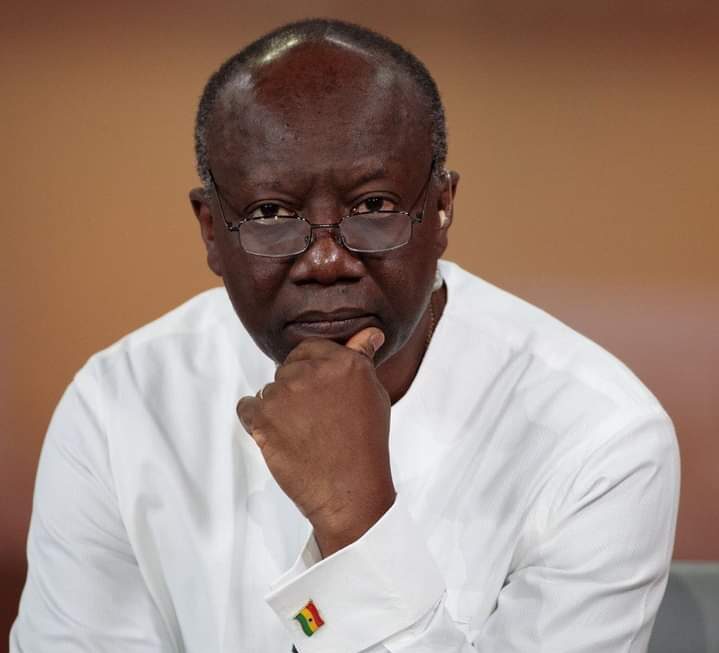

Minister-designate for Finance Ken Ofori-Atta has attributed his recovery to divine intervention as he acknowledges even the doctors felt “someone upstairs” was watching over him. Mr Ofori-Atta had to fly to the United States of America (USA) to seek medical care after suffering post-Covid complications. Virtually joining a post-budget forum organized by KPMG on Tuesday, March 16, Mr Ofori-Atta said: “For me personally, I guess I would want to reiterate how merciful the Lord has been to me and also grateful for the prayer support from my family. “The challenge is my post-COVID-19 symptoms. It is in the Bible that says Peter, therefore, was kept in prison, but prayer was made without ceasing for the church and for him and I have felt how God miraculously delivered Peter from prison because the saints prayed for him.” He added: “The doctors here have been fantastic and very dedicated, but even they acknowledge that there must be someone upstairs who is watching over me because the numbers were so critical. So thank you indeed for your earnest prayers which have saved me.” Despite missing out on his vetting, thereby making the president, Nana Addo Dankwa Akufo-Addo, authorize the Minister of State in charge of Parliamentary Affairs, Osei Kyei-Mensah-Bonsu, to read the 2021 budget statement and government’s financial policy, Mr Ofori-Atta, who has been the Finance Minister since 2017, shared his thoughts, particularly on the Covid recovery efforts by various governments across the globe. “…Globally, countries are looking at preserving lives and livelihoods and stimulating the economy for growth amidst this pandemic and I think we [Ghana] are not doing any less.” 3news Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0555568093.

Ken Ofori-Atta to make first public appearance after medical check-up?

The Minister-designate for Finance Ken Ofori- Atta will most likely make what will be his first public appearance in a long while. For what the public knows, the former Finance Minister is in the United States of America receiving medical attention having suffered post COVID-19 recovery complications. Rumours went rife on Monday, February 15, 2021, that the Minister-designate for Finance had passed away in the United States having left the country the previous day. His Special Aide, Michael Bediako dousing the rumours in a social media post, indicated that Mr Ofori-Atta was alive and in good spirits. Since then, no update has been made on his status and it is yet to be established whether the Minister-designate has returned to the country. However, if the information picked up by GhanaWeb is anything to go by, Mr Ofori-Atta will on Tuesday, March 16, 2021, make an appearance at a Budget Forum set to be organized by audit firm, KPMG. The forum according to further details picked up by GhanaWeb will be hosted virtually and will have other speakers such as Senior Partner at KPMG – Mr Anthony Sarpong, former Deputy Minister of Finance – Charles Adu Boahen participating in the forum. Mr Andrew Akoto, Mr Kofi Frimpong-Kore, Ms. Eva Mends, Dr Priscilla Twumasi Baffour and Mr Seth Twum-Akwaboah will also be part of the said forum. Mr Ofori Atta was scheduled to be vetted by Parliament’s Appointment Committee on Tuesday, February 16, 2021, but missed his appointment with the committee to due to his health. The Minister for Parliamentary Business, Simon Osei Kyei-Mensah-Bonsu has been nominated by the President to act in his stead as Minister of Finance. Ghanaweb Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0555568093

You don’t tax more to help mend the economy – Manasseh Azure

Ace Broadcast Journalist, Manasseh Azure Awuni has reacted to portions of the 2021 budget as delivered by Parliamentary Affairs Minister, Osei Kyei-Mensah-Bonsu on Friday, January 12, 2021. Osei-Kyei Mensah presented the budget on behalf of the Finance Minister, Ken Ofori-Atta who is currently receiving medical attention in the United States. As part of the presentation, he introduced some new taxes and levies are aimed at helping to recover the economy which government says has been negatively impacted by the COVID-19 pandemic. These levies and taxes include the COVID-19 Health Levy, Road Toll increases, Gaming Tax, Sanitation and pollution Levy(Bola Tax), 1% Increase in NHIL, 1% increase in Vat flat rate, ESLA increase, and the financial sector clean up Levy 5%. Though tax reliefs were granted for commercial vehicles as part of measures to reduce the cost of transportation and in areas like the arts and entertainment institutions, hotels, restaurants and travel and tours, many have still reacted to the move. For them, it is inappropriate to introduced taxes particularly at a time like this, when the economy is recovering from the harsh impact of the novel coronavirus pandemic. Minority Leader, Haruna Idrissu for instance, described the move as insensitive, whilst accusing the government of mismanaging the economy. In a tweet, Manasseh Azure also added his voice; “When the economy is shrinking and jobs are lost, you don’t tax more to “help the economy recover,” he said. Ghanaweb Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0555568093

Overall broad cash budget deficit 10.8% of GDP – Addison

Bank of Ghana Governor Dr Ernest Addison has said as far as the execution of the budget is concerned, “provisional data released by the Ministry of Finance as of November 2020, showed an overall broad cash budget deficit of 10.8 per cent of GDP against the target of 11.4 per cent of GDP for the year”. Chairing the Monetary Policy Committee meeting on Monday, 1 February 2020 at which the policy rate was maintained at 14.5 per cent, Dr Addison said: “The primary balance also recorded a deficit of 4.9 per cent of GDP which was marginally above the target of 4.8 per cent of GDP”. “Over the review period, total revenue and grants amounted to GHS46.5 billion (12.1 per cent of GDP), marginally higher than the revised target of GHS46.0 billion (11.9 per cent of GDP)”, he reported. Total expenditures and arrears clearance amounted to GHS88.2 billion (22.9 per cent of GDP) against the revised target of GHS88.4 billion (22.9 per cent of GDP), he noted. The “elevated fiscal path”, he indicated, “has impacted the stock of public debt which rose to 74.4 per cent of GDP (GHS286.9 billion) at the end of November 2020 compared with 62.4 per cent of GDP (GHS218.2 billion) at the end of December 2019”. “Of the total debt stock, domestic debt was GHS147.3 billion (38.2 per cent of GDP), while external debt was GHS139.6 billion (36.2 per cent of GDP)”, Dr Addison added. Read the full statement below: Good morning, Ladies and Gentlemen of the Media. Welcome to the 98th Monetary Policy Committee (MPC) press briefing, and the first in the year 2021. The MPC met last week and reviewed recent global and domestic developments including the outlook for the economy. Permit me to share with you highlights of the developments and key considerations that informed the decision of the Committee on the Policy Rate. 1. The global economy was projected to contract by a larger margin in 2020 due to the adverse effects of the COVID-19 pandemic, but the contraction has turned in better than earlier forecasted. The resurgence of infections and emergence of new variants of the virus since the last quarter of 2020 has, however, resulted in the re-imposition of restrictions and partial lockdowns in some economies and will likely soften the growth recovery momentum in early 2021. Notwithstanding the anticipated softening, global growth is expected to strengthen in the second half of 2021, conditional on continued policy support and successful rollout of COVID-19 vaccines. Prospects for 2021 look more positive, and the January update of the IMF’s World Economic Outlook projects a rebound in the global economy from the 3.5 per cent contraction in 2020 to a 5.5 per cent growth in 2021, amid uncertainties. 2. Global financing conditions remained accommodative throughout 2020, reflecting the massive policy support which induced lower borrowing costs, boosted equity valuations, enhanced investor risk appetite, and narrowed sovereign bond spreads across Emerging Market and Developing Economies. These developments helped ease pressures on emerging and frontier market currencies, while sovereign risk spreads for most sub-Saharan African countries declined steadily in the year. In the near-term, financial market indicators point to optimism about medium-term prospects. Nonetheless, rising debt levels and increasing interest burdens across several emerging markets and developing economies pose significant financing risks. 3. Global inflationary pressures remained subdued, weighed down by weak global demand and significant slack in labour and product markets during 2020. In Advanced Economies, inflation is projected to rise to 1.3 per cent in 2021 from 0.7 per cent in 2020, while in Emerging Market and Developing Economies, inflation is expected to ease slightly to 4.2 per cent from 5.0 per cent over the same comparative period. In emerging market and frontier economies, currency movements and COVID-related supply-side constraints are expected to dictate price movements, going forward. 4. In Ghana, after recording strong growth of 6.5 per cent in 2019 and firm growth of 4.9 per cent in the first quarter of 2020, growth was dampened in the second quarter due to COVID-related factors. However, following the lifting of restrictions and strong policy support, signs of recovery begun to emerge in the third quarter. Data released by the Ghana Statistical Service showed that real GDP growth provisionally contracted by 1.1 per cent in the third quarter of 2020 compared to the 3.2 per cent contraction recorded in the second quarter. In particular, non-oil GDP recorded a more measured contraction of 0.4 per cent in the third quarter of 2020, compared to a contraction of 3.4 per cent in the second quarter. 5. The Bank of Ghana’s updated Composite Index of Economic Activity (CIEA) recorded an annual growth of 11.9 per cent in November 2020, compared with 3.4 per cent growth a year ago. The key drivers of economic activity during the period were construction, port activity, imports, manufacturing, and credit to the private sector. 6. Results from the Bank’s latest confidence surveys conducted in December 2020 showed improvements in both consumer and business confidence. Consumer confidence remained firm at pre-lockdown levels reflecting optimism about current economic conditions following the gradual lifting of the COVID-related restrictions. Business confidence improved significantly, reaching pre-lockdown levels, for the first time, as businesses met short-term company targets and expressed positive sentiments about growth prospects. 7. Price developments in 2020 were broadly driven by COVID-related factors, especially the spike in inflation observed during the second quarter which was on the back of events preceding the partial lockdown. This was followed by the subsequent easing in inflation pressures in the third and last quarters, as the restrictions were removed. Two readings since the last MPC meeting indicated that headline inflation eased from 10.1 per cent in October to 9.8 per cent in November and then, subsequently rose to 10.4 per cent in December 2020. The inflation uptick in December was mainly driven by food inflation, which moved up to 14.1 per cent from 11.7 per cent in November. Non-food inflation, however, eased to 7.7 per cent from

Ministerial list: Names coming and their possible positions

Considering the general order of things, the poorly-performing ministers are more likely to be dropped as some other new personality likely to replace them. Already, some names have pop up as potential ministers under the newly formed Akufo-Addo-led administration, some of these include maintained ministers who may be moved to other ministries, some who may be maintained in their ministries and others who may be the freshers in the team. Reshuffled ministers: According to a Dailyguide newspaper report, former Education Minister Dr Matthew Opoku Prempeh (Napo) may be taking on John Peter Amewu’s former job as Energy Minister whilst Mr Amewu who is now the Hohoe MP moves to the Railways Ministry as substantive Minister. This will leave Mr Opoku Prempeh’s position for his former Deputy, Dr Yaw Osei Adutwum who was quite cooperative with the administration of his duties in his previous capacity. Dan Botwe who was iconic with the reorganization and establishment of the 6 new regions as Regional Reorganisation and Development Minister is likely, per DailyGuide’s report, to be moved to the Ministry of Local Government and Rural Development which was previously occupied by Hajia Alima Mahama. Samuel Atta Akyea who was Works and Housing Minister may be moved to the Environment Ministry as its Minister. Retained Ministers: For those who particularly left distinctive marks after their first term, they have been projected to retain their various ministerial appointments. Finance Minister, Ken Ofori-Atta, Roads Minister who spearheaded the Year of Roads project, Kwasi Amoako Atta has also been named, Communications and Information Ministers, Ursula Owusu-Ekuful and Kojo Oppong Nkrumah respectively, have been mentioned for this category. Dr Owusu Afriyie Akoto, Food and Agriculture minister who spearheaded the Planting for Food and Jobs Policy, Trade Minister, Alan Kyerematen, and Foreign Affairs and Regional Integration Minister, Shirley Ayorkor Botchwey also have their names emerging for retaining. Defence Minister, Dominic Nitiwul, Ambrose Dery, Interior Minister, Gender Minister, Cynthia Morrison and Transport Minister, Kwaku Ofori Asiamah also made the speculated list as reported by DailyGuide. It is still unknown, however, what the fate of Attorney General, Gloria Afua Akuffo will be moving forward; whether or not she will be maintained or if there even is any possibility of her being replaced by her deputy Godfred Dame who has become more popular in recent times. Apexnewsgh.com/Ghana Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0555568093.