The Bank of Ghana (BoG) has dismissed reports suggesting a ban on over-the-counter (OTC) foreign currency withdrawals. This announcement comes amid public debate and political claims regarding a possible crackdown on access to U.S. dollars. Apexnewsgh reports

On Thursday, May 15, the Central Bank issued a statement reaffirming that customers can continue to make cash withdrawals in foreign currency under the existing foreign exchange regulations. “Over-the-counter (OTC) cash withdrawals in foreign currency from Foreign Exchange Accounts (FEA) and Foreign Currency Accounts (FCA) are allowed,” the Bank clarified.

This clarification follows comments made by Isaac Adongo, the Member of Parliament for Bolgatanga Central and a Board Member of the Bank of Ghana. Mr. Adongo had raised concerns, suggesting that the Central Bank was planning to implement tighter controls on OTC dollar withdrawals as part of measures to stabilize the Ghanaian cedi. However, the BoG unequivocally rejected these claims, stating that no such review is currently under consideration.

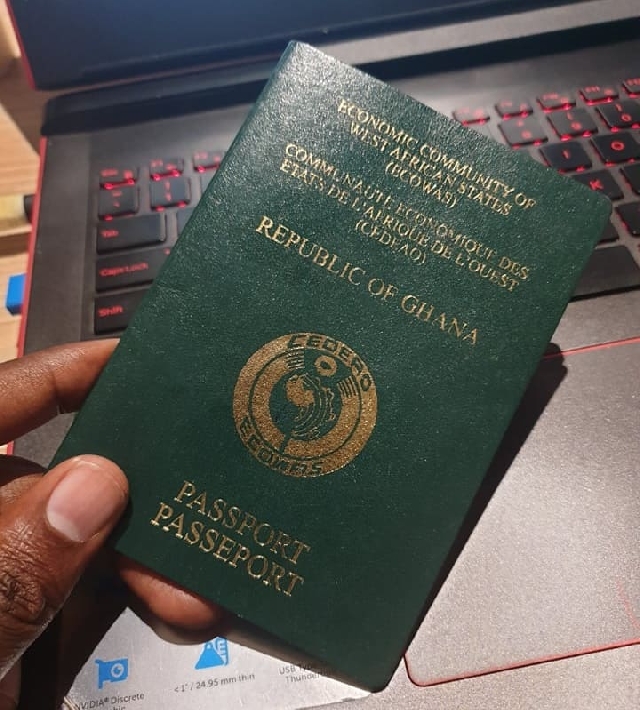

Additionally, the Bank reminded the public that individuals without FEA or FCA accounts can still purchase foreign currency for travel—up to a maximum of $10,000 per person per trip—if they present a valid passport, visa, and confirmed travel ticket, in accordance with BoG Notice No. BG/GOV/SEC/2014/09.

“Cheques and cheque books may continue to be issued on FEA and FCA accounts,” the statement emphasized, reassuring the public that standard banking operations remain unaffected.

The BoG’s clarification arrives during a period of heightened concern over foreign exchange availability, especially as the cedi faces ongoing pressure despite some recent gains. The demand for the U.S. dollar remains robust among importers, international businesses, and outbound travelers.

In conclusion, the Bank urged commercial banks and the public to adhere to the existing guidelines and reinforced that “The Bank has not contemplated reviewing these existing measures.” This statement aims to restore confidence in the foreign exchange system and alleviate fears about access to foreign currency.

Source: Apexnewsgh.com