The Bank of Ghana (BoG), in collaboration with the Ghana Journalists Association (GJA), organized a landmark media engagement workshop on Non-Interest Banking and Finance (NIBF) . Apexnewsgh reports

The initiative held in Koforidua from July 18 to 20, 2025, aimed at enhancing media understanding of NIBF as a tool for ethical, inclusive, and sustainable financial development in Ghana.

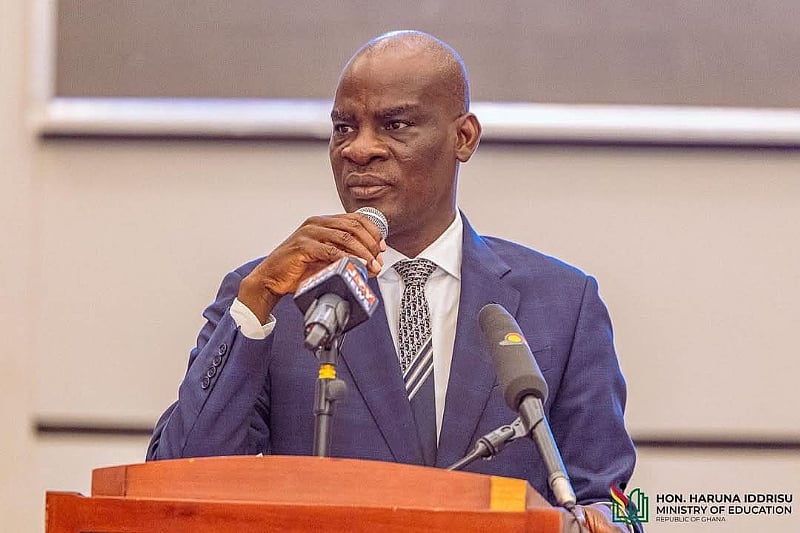

Speaking on behalf of the Governor, Dr. Johnson P. Asiama, the Director of Banking Supervision Department, Mr. Ismail Adam, reiterated the Bank’s commitment to creating a robust legal and institutional framework for implementing non-interest banking.

“This workshop is part of BoG’s broader stakeholder engagement strategy to equip the media to lead public education efforts,” Mr. Adam said.

Non-Interest Banking, also known as Islamic or Participatory Banking, operates on profit-and-loss sharing principles and prohibits interest-based or unethical transactions such as gambling and speculative investments. It is open to all Ghanaians, regardless of religion, and complements conventional banking.

With global NIBF assets surpassing USD 5 trillion in 2024, Mr. Adam stressed its growing influence in both Muslim and secular economies.

He noted that NIBF supports key goals of the UN Sustainable Development Goals (SDGs), particularly reducing inequality, promoting decent work, and financing infrastructure projects through ethical means.

Participants, including media practitioners, were sensitized on the fundamentals of Islamic finance, its role in financial inclusion, risk-sharing, and sustainable development.

They were also urged to demystify misconceptions such as that Islamic banking is solely religious or a threat to conventional banking and instead promote its benefits for SMEs, trade, and Ghana’s 24-hour economy.

Special commendation was given to Prof. John Gartchie Gatsi, Advisor to the Governor on NIBF, for his leadership in spearheading the initiative.

The BoG emphasized its inclusive approach—bringing on board Christians and Muslims alike—to build a financial system that is representative, equitable, and supportive of Ghana’s economic aspirations.

A national policy on NIBF is currently being developed.

The workshop forms part of BoG’s multi-phase stakeholder engagement strategy targeting professional bodies, academia, regulators, and the media.

The overarching goal is to integrate NIBF into Ghana’s mainstream financial ecosystem, increase foreign direct investment, and enhance socio-economic development.

Journalists lauded the initiative as timely, strategic, and vital for public financial literacy.

Source: Apexnewsgh.com/Ngamegbulam Chidozie Stephen