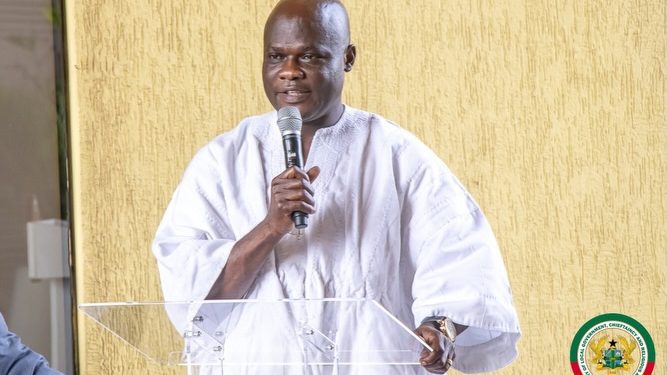

Former President John Mahama has urged the minority caucus to closely monitor the Bank of Ghana’s handling of the recent disbursement of $600 million by the International Monetary Fund (IMF).

This disbursement is part of a $3 billion three-year extended credit facility approved in May 2023. Mahama expressed concerns about the Bank of Ghana’s role in exacerbating Ghana’s economic challenges by flooding the market with newly-printed currency.

In a Facebook post, Mahama emphasized the need for responsible and judicious use of the IMF funds by the government. He called on the outgoing NPP government to exercise caution and urged other development partners like the World Bank to closely monitor the utilization of funds.

Mahama assured the public that his party would closely scrutinize the government’s actions concerning the funds.

The minority caucus, led by Cassiel Ato Forson, previously marched to demand the resignation of the Bank of Ghana’s Governor, Dr. Ernest Addison, and his deputies.

They accused the Bank of printing GHS80 billion ($14.4 billion) illegally between 2021 and 2022, contributing to a hyperinflation rate of 54.1% in December 2022. The caucus alleged that GHS22.04 billion ($3.98 billion) of the printed money was used to support the government’s budget without parliamentary approval, leading to an increase in poverty levels.

The Bank of Ghana denied these allegations, explaining that the referenced GHS22.04 billion was part of the total financing captured in the Mid-Year Fiscal Policy Review document.

The central bank clarified that the losses and negative equity recorded were technical and related to accounting standards and expected credit losses from government debt. Governor Addison reminded Ghanaians that historical financial statements showed previous episodes of negative equity, which were resolved successfully.

Governor Addison affirmed that the Bank of Ghana had enough income to cover operational costs and maintained sufficient capital. He highlighted that the Bank had complied with applicable laws and vehemently denied claims of annual financing of the government. He explained that financing had only occurred during the pandemic in 2020 and the crisis year of 2022, both within the boundaries of the Bank of Ghana Act.

The Bank of Ghana stressed its commitment to managing operational costs and continued adherence to legal requirements. It reassured the public that its financial position would not negatively impact its operations. The Bank promised to reduce costs further and reassess the capital position in the year 2027.

Former President Mahama’s calls for vigilance on the use of IMF funds reflects the ongoing scrutiny of the Bank of Ghana’s actions, as allegations of printing money without proper authorization contribute to concerns about the country’s economic stability.

Source: Ngamegbulam Chidozie Stephen

Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 0256336062