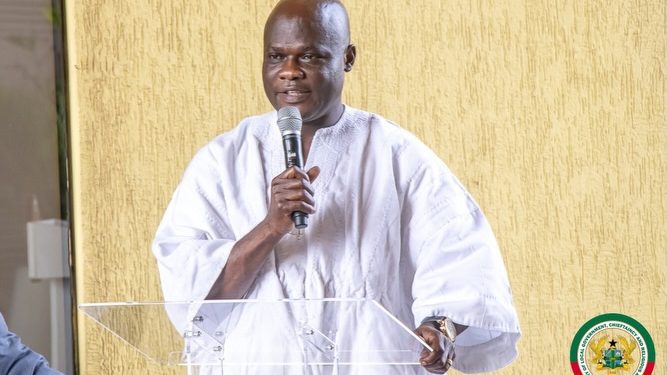

The Member of Parliament for Navrongo Central Mr. Sampson Tangombu Chiragia has described the E-transaction-Levy captured in the 2022 budget as a killer levy that is centered on a common person.

The Navrongo legislator made the revelation during an exclusive interview with Apexnews-Ghana on Wednesday, December 8, 2021, the Navrongo Central legislator said, the region was neglected.

According to the MP, the National Democratic Congress (NDC) is not against the tax because no country will develop without tax. But they are concerned about the innocent common person on the street struggling to get 3 square meals a day but are forced to pay what he described as a lot of levy and taxes’

Tangombu Chiragia further pointed that, they are not against Ofori-Atta coming to read the budget, because a budget is an estimate of what is supposed to be done for the development of this country. He explained, “…the issues we think the budget is not going to help a common person and as a social democratic party. You can understand that the budget is targeted to the common person and our aim is normally looking at the gap between the poor and the rich, but this particular budget is poorly centered. That’s why we are saying that there are certain issues that should be resolved so that, we can have the budget approved”.

“Actually, there are a lot of taxes are centered on the common person, if you remember the 2022 budget, they were a lot of tax including borla tax and that is why today, the borla taxes are very high because of a number of taxes involved. The actual fuel price is not like we see it today but mostly about 42 to 48 percent are taxes, Ghanaians have already been taxed a lot.

“Nobody is against tax, because without tax we cannot develop, but the taxes are a lot. The current Budget as we are talking about, if you look it very well, the benchmark values which we are all enjoying the discount of 50% at the port, they are withdrawing it. If they withdraw the benchmark it now means that all the cost of goods and services brought into this country will go back by a certain percentage. Because, if you are paying Ghc 50.00 for goods brought into this country, with the withdrawal of the benchmark you are now going to pay Ghc 100.00 and that will be passed to the common person and there are some other hidden taxes that people are not aware of”.

“Before they came to power, the wholesalers and retailers are paid VAT flat. When you are a flat-rate taxpayer, it means that you pay only a cooperate levy of 1%, a flat rate taxpayer doesn’t pay GETFund levy and Health Insurance Levy totaling 5%. So, if they are moving you from a flat rate to a standard rate, it means you are now coming to pay the levy as high as 6%. So, those wholesalers and retailers whose annual income is more than 500.000 will have to pay the levies of 6% before VAT is put on top and NPP people think they are very wise. They don’t talk about tax, they talk about levies.

“E-Levy is a killer levy, Imagine you are a teacher or a civil servant and they have transferred you from Bolgatanga to Accra and your wife and children are all in Bolga. Then, at the end of the day, your salary is not even enough, the government increases your salary by 4% annually and that 4% percent of Ghc 3000.00 which is about Ghc 120.00 and you are sending chop money of Ghc 1000.00 to your wife in Bolga for upkeep, which means you have to pay 1.75 percent. So, you can see, you are paying the tax again on income and that is now even the final tax is a levy”. Tangombu Chiragia explains

Apexnewsgh.com/Ghana/Ngamegbulam Chidozie Stephen

Please contact Apexnewsgh.com on email apexnewsgh@gmail.com for your adverts and credible news publications. Contact: 05555568093