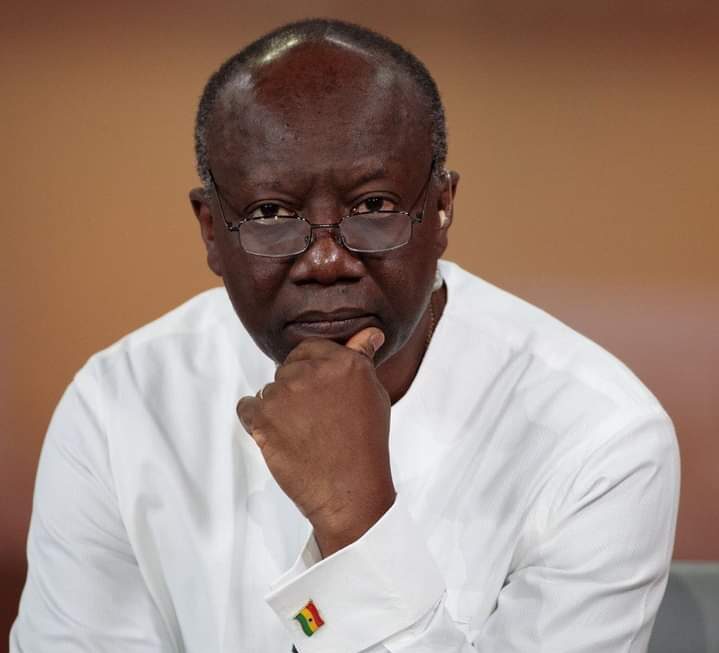

Over 6,000 Ghanaian lawyers and doctors are not paying taxes, this is according to Finance Minister Ken Ofori-Atta.

The country’s purse holder made this revelation in an interview on Asaase Radio where he also disclosed that 60,000 business people have been evading tax, per an exercise conducted by the Ghana Revenue Authority (GRA).

“…We went through the exercise to sort of titrating to see what we’ve got, and we got about 60,000 businesspeople who were not paying taxes…some 5,000 or 6,000 lawyers are not. Some doctors [are not paying income tax]…so you begin to see all of these professionals, all of us on social media ranting against the government and [realise] that most of these people are not even paying taxes,” Mr. Ken Ofori-Atta shared.

Having established that fact, he said Ghanaians should stop lashing out at government when things are hard as he encouraged businesses and the citizenry to at all times comply and pay taxes to help in the execution of projects and policies to develop the country.

According to Ken Ofori-Atta, the current revenue target of the GRA gives him hope that government will be able to carry out projects to develop the country.

“If GRA is telling us that we are targeting GHC57 billion for this year, it means that if you have half of that – let’s say GHC30 billion – another GHC30 billion is sitting there somewhere in the wings.

“Now that’s an enormous amount of resources that we can tap into, to be able to fund development projects. And that’s what gives me the excitement and hope that we can really fund this development [agenda]. The exciting thing, after four years of the administration and being given the mandate for another four years, is that a lot of learning has occurred,” the Finance Minister noted.

Ken Ofori-Atta concluded, “usually when we talk about compliance people are quite cynical about that: can GRA step up their game and do much better? So, structurally, we are changing. And thanks to the vice-president’s push on digitization, we are getting there.”

—Eric Nana Yaw KwafoPlease contact Apexnewsgh.com on email apexnewsgh@gmail.com for your credible news publications. Contact: 05555568093